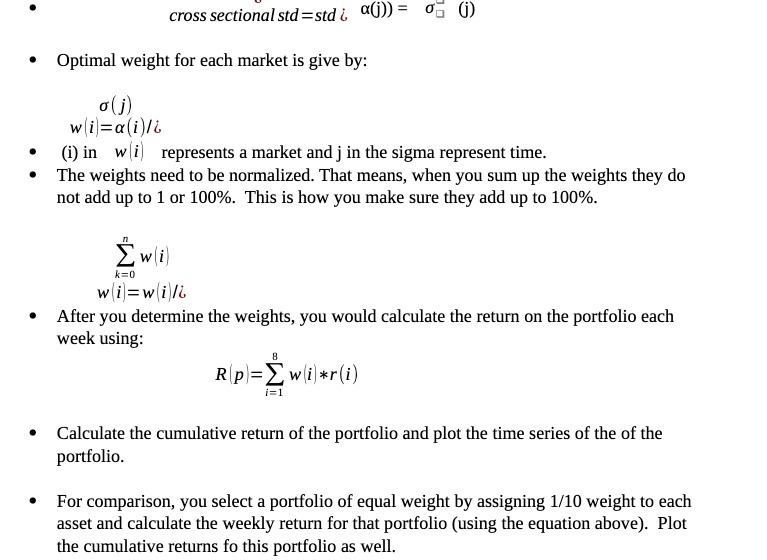

Question: cross sectional std=std & a(j)) = (j) Optimal weight for each market is give by: . (j) w(i=a(i)/i (i) in w(i) represents a market

cross sectional std=std & a(j)) = (j) Optimal weight for each market is give by: . (j) w(i=a(i)/i (i) in w(i) represents a market and j in the sigma represent time. The weights need to be normalized. That means, when you sum up the weights they do not add up to 1 or 100%. This is how you make sure they add up to 100%. w(i) k=0 wi=will After you determine the weights, you would calculate the return on the portfolio each week using: 8 Rp=wi*ri) i=1 Calculate the cumulative return of the portfolio and plot the time series of the of the portfolio. For comparison, you select a portfolio of equal weight by assigning 1/10 weight to each asset and calculate the weekly return for that portfolio (using the equation above). Plot the cumulative returns fo this portfolio as well.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts