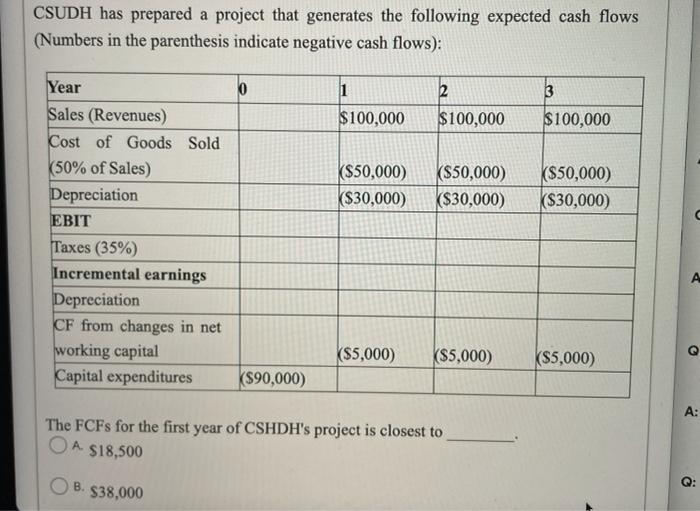

Question: CSUDH has prepared a project that generates the following expected cash flows (Numbers in the parenthesis indicate negative cash flows): 0 1 2 3 $100,000

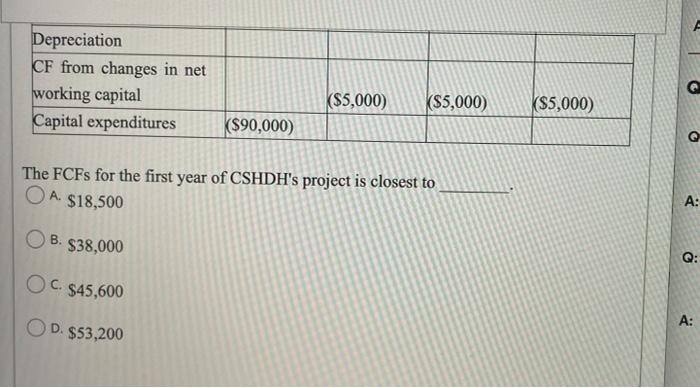

CSUDH has prepared a project that generates the following expected cash flows (Numbers in the parenthesis indicate negative cash flows): 0 1 2 3 $100,000 $100,000 $100,000 ($50,000) ($30,000) ($50,000) ($30,000) ($50,000) K$30,000) Year Sales (Revenues) Cost of Goods Sold (50% of Sales) Depreciation EBIT Taxes (35%) Incremental earnings Depreciation CF from changes in net working capital Capital expenditures ($5,000) Q ($5,000) K$5,000) |$90,000) A: The FCFs for the first year of CSHDH's project is closest to $18,500 A . $38,000 Depreciation CF from changes in net working capital Capital expenditures ($5,000) (S5,000) $5,000) K$90,000) The FCFs for the first year of CSHDH's project is closest to O A $18,500 A: B. $38,000 OC. $45,600 A: OD. $53,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts