Question: CSUDH has prepared a project that generates the following expected cash flows (Numbers in the parenthesis indicate negative cash flows): Year 0 1 2 3

CSUDH has prepared a project that generates the following expected cash flows (Numbers in the parenthesis indicate negative cash flows):

| Year | 0 | 1 | 2 | 3 |

| Sales (Revenues) |

| $100,000 | $100,000 | $100,000 |

| Cost of Goods Sold (50% of Sales) |

| ($30,000) | ($50,000) | ($50,000) |

| Depreciation |

| ($20,000) | ($30,000) | ($30,000) |

| EBIT |

| |||

| Taxes (35%) |

| |||

| Incremental earnings |

| |||

| Depreciation |

| |||

| CF from changes in net working capital |

| ($5,000) | ($5,000) | ($5,000) |

| Capital expenditures | ($90,000) |

|

|

|

The FCF for the first year of CSHDH project is closest to ________.

| A. | $63,500 | |

| B. | $47,500 | |

| C. | $38,000 | |

| D. | $18,500 |

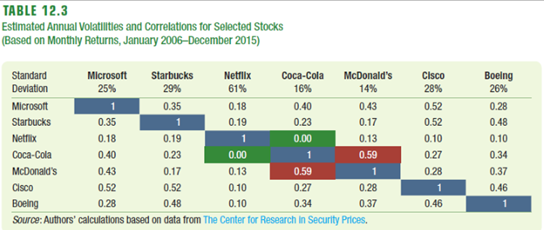

Using the data from Table 12.3, what is the volatility (standard deviation) of an equally weighted portfolio of Starbucks and Boeing stock?

| A. | 44.7% | |

| B. | 34.3% | |

| C. | 28.3% | |

| D. | 23.7% |

Ford Motor Company had realized returns of 10%, 20%, -5%, and -5% over four quarters. What is the quarterly standard deviation of returns for Ford?

| A. | 14.25% | |

| B. | 15.25% | |

| C. | 16.25% | |

| D. | 12.25% |

The amount by which a firm's earnings are expected to change as a result of an investment decision is defined as incremental earnings.

True

False

TABLE 12.3 Estimated Annual Volatilities and Correlations for Selected Stocks (Based on Monthly Returns, January 2006 December 2015) 16% Standard Microsoft Starbucks Netflix Coca-Cola McDonald's Deviation 25% 29% 61% 14% Microsoft 1 0.35 0.18 0.40 0.43 Starbucks 0.35 1 0.19 0.23 0.17 Netflix 0.18 0.19 1 0.00 0.13 Coca-Cola 0.40 0.23 0.00 0.59 McDonald's 0.43 0.17 0.13 0.59 1 Cisco 0.52 0.10 0.27 0.28 Boeling 0.28 0.10 0.34 0.37 Source: Authors' calculations based on data from The Center for Research in Security Prices. Cisco 28% 0.52 0.52 0.10 0.27 0.28 1 0.46 Boeing 26% 0.28 0.48 0.10 0.34 0.37 0.46 0.52 0.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts