Question: ctice Exercises i Saved Help Save & Exit Submit Check my work 6 Adam Fleeman, a skilled carpenter, started a home improvement business with Tom

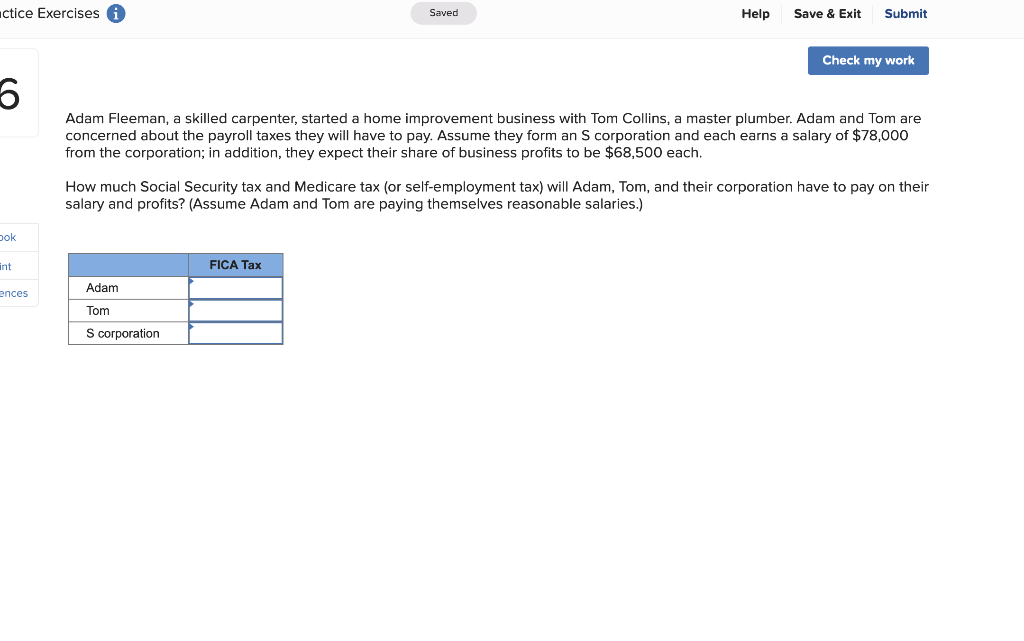

ctice Exercises i Saved Help Save & Exit Submit Check my work 6 Adam Fleeman, a skilled carpenter, started a home improvement business with Tom Collins, a master plumber. Adam and Tom are concerned about the payroll taxes they will have to pay. Assume they form an S corporation and each earns a salary of $78,000 from the corporation; in addition, they expect their share of business profits to be $68,500 each. How much Social Security tax and Medicare tax (or self-employment tax) will Adam, Tom, and their corporation have to pay on their salary and profits? (Assume Adam and Tom are paying themselves reasonable salaries.) bok int FICA Tax Adam ences Tom S corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts