Question: ldpler 22 1 Saved Help Save & Exit Submit Check my work 4 ere 1-10 4.16 points Harry, Hermione, and Ron formed an S corporation

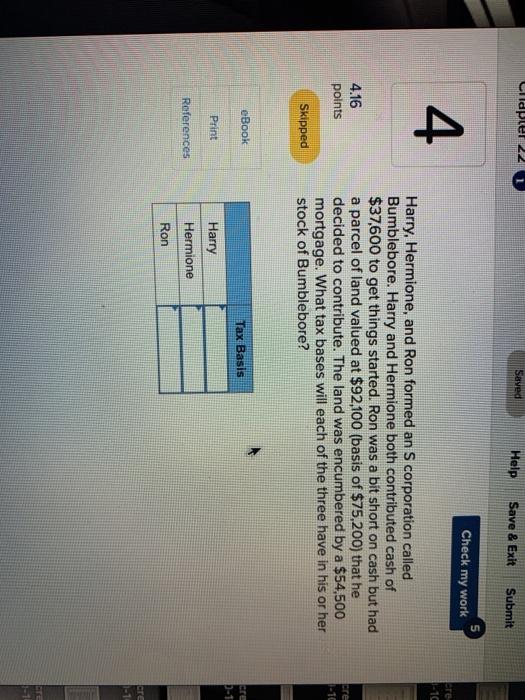

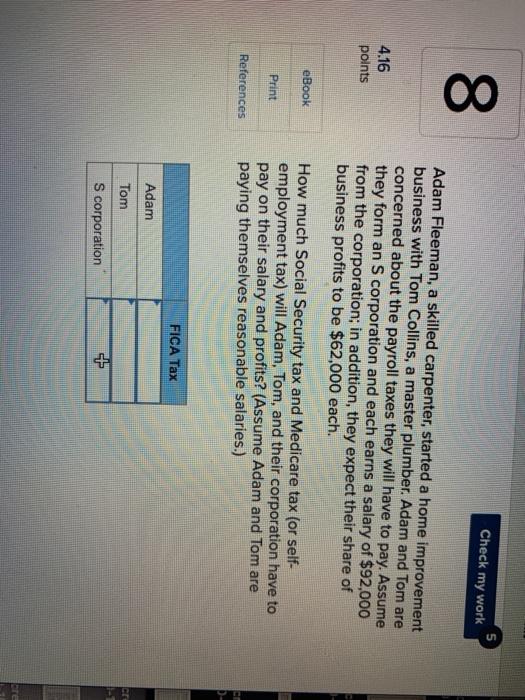

ldpler 22 1 Saved Help Save & Exit Submit Check my work 4 ere 1-10 4.16 points Harry, Hermione, and Ron formed an S corporation called Bumblebore. Harry and Hermione both contributed cash of $37,600 to get things started. Ron was a bit short on cash but had a parcel of land valued at $92,100 (basis of $75,200) that he decided to contribute. The land was encumbered by a $54,500 mortgage. What tax bases will each of the three have in his or her stock of Bumblebore? cre Skipped eBook Tax Basis cre Print Harry References Hermione Ron cre Check my work 8 4.16 points Adam Fleeman, a skilled carpenter, started a home improvement business with Tom Collins, a master plumber. Adam and Tom are concerned about the payroll taxes they will have to pay. Assume they form an S corporation and each earns a salary of $92,000 from the corporation; in addition, they expect their share of business profits to be $62,000 each. eBook Print How much Social Security tax and Medicare tax (or self- employment tax) will Adam, Tom, and their corporation have to pay on their salary and profits? (Assume Adam and Tom are paying themselves reasonable salaries.) References CO FICA Tax Adam Tom S corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts