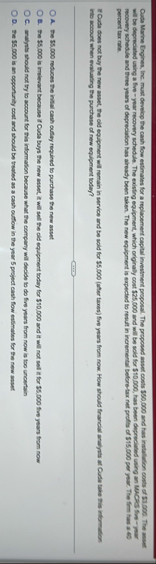

Question: Cuds Marine Eingines, Inc, must develop the cash flow estimates for a replacement eapital investment proposal. The proposed asset costs 5 0 0 , 0

Cuds Marine Eingines, Inc, must develop the cash flow estimates for a replacement eapital investment proposal. The proposed asset costs and has instalidion oosts of oo The ancer percert tax rate. into wocourt when evaluating the purchase of new equipment lodiay?

A The reduces the inital cash outiey required to purchase the new aspet

E The $ is impievart because if Cuda buys the new aviet, it will sell the old equipmert lioday for $ and it will not sell if for $ p five years from now

C anabite thould not try to account for this information because what the compary will dedide to do five years from now is top uncertain

D The is an oppofinity coet and ahould be treated as a cash outlow in the year project eash flow estimates for the new atset

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock