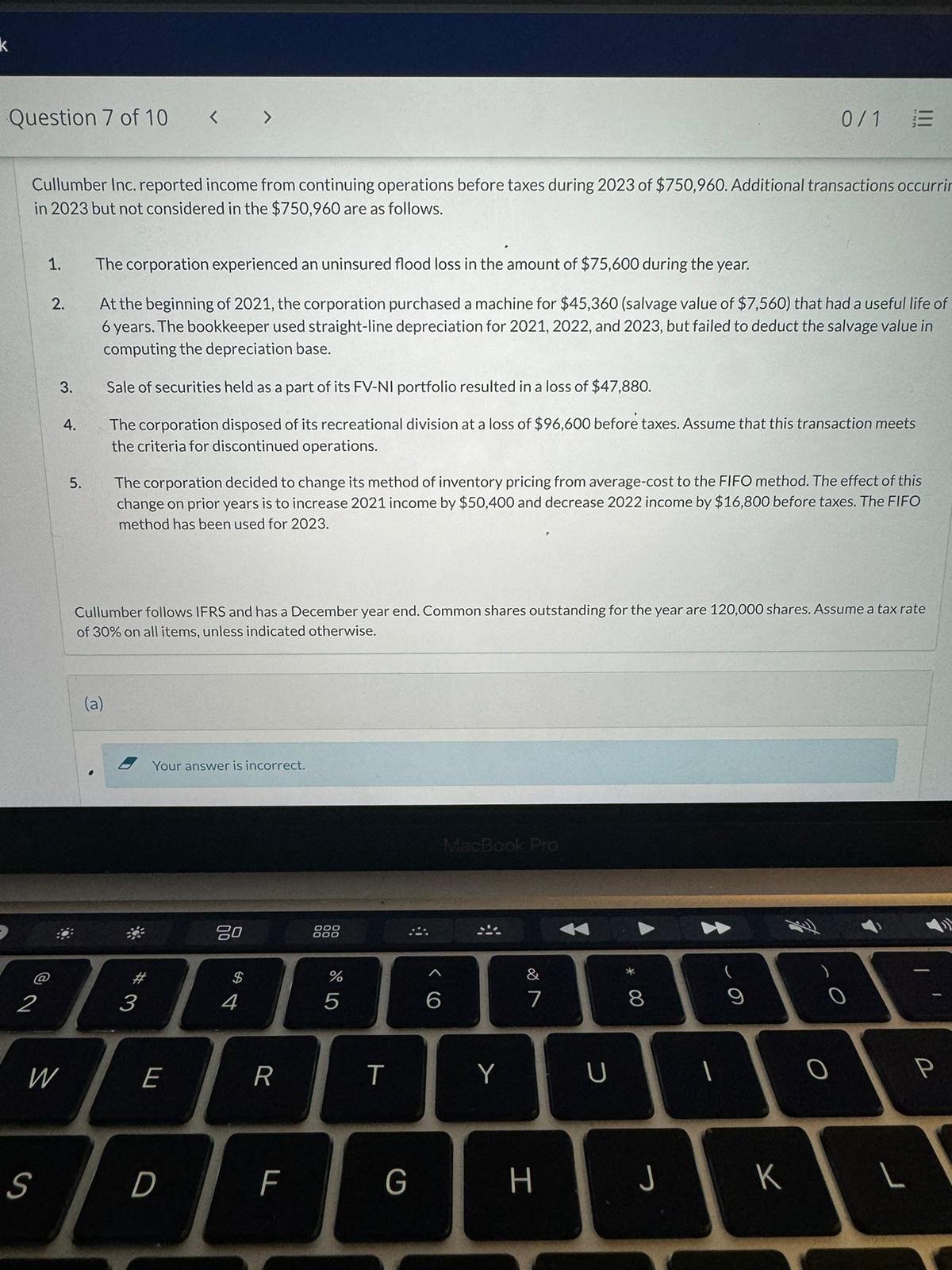

Question: Cullumber Inc. reported income from continuing operations before taxes during 2 0 2 3 of $ 7 5 0 , 9 6 0 . Additional

Cullumber Inc. reported income from continuing operations before taxes during of $ Additional transactions occurring in but not considered in the $ are as follows.

The corporation experienced an uninsured flood loss in the amount of $ during the year.

At the beginning of the corporation purchased a machine for $salvage value of $ that had a useful life of

years. The bookkeeper used straightline depreciation for and but failed to deduct the salvage value in

computing the depreciation base.

Sale of securities held as a part of its FVNI portfolio resulted in a loss of $

The corporation disposed of its recreational division at a loss of $ before taxes. Assume that this transaction meets the criteria for discontinued operations.

The corporation decided to change its method of inventory pricing from averagecost to the FIFO method. The effect of this

change on prior years is to increase income by $ and decrease income by $ before taxes. The FIFO

method has been used for

Cullumber follows IFRS and has a December year end. Common shares outstanding for the year are shares. Assume a tax rate

of on all items, unless indicated otherwise.

a Calculate the revised income from continuing operation

b Prepare an income statement for the year starting with income from continuing operations before taxes. Compute earnings per share as it should be shown on the face of the income statement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock