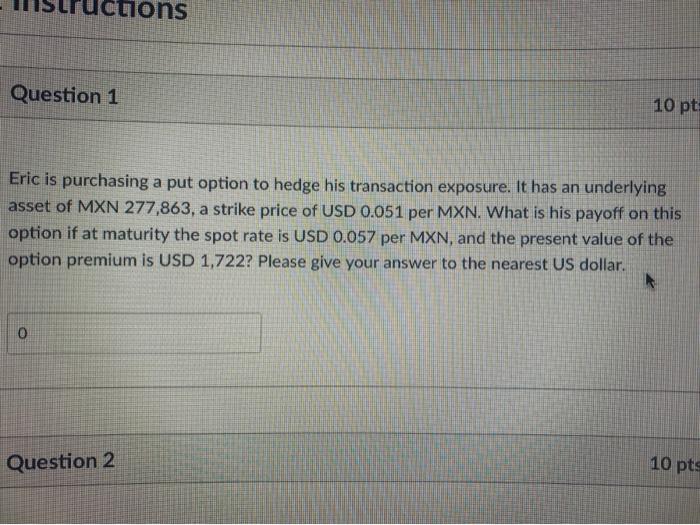

Question: culons Question 1 10 pt Eric is purchasing a put option to hedge his transaction exposure. It has an underlying asset of MXN 277,863, a

culons Question 1 10 pt Eric is purchasing a put option to hedge his transaction exposure. It has an underlying asset of MXN 277,863, a strike price of USD 0.051 per MXN. What is his payoff on this option if at maturity the spot rate is USD 0.057 per MXN, and the present value of the option premium is USD 1,722? Please give your answer to the nearest US dollar. 0 Question 2 10 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts