Question: MPI Incorporated has $3 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 12%, and its return

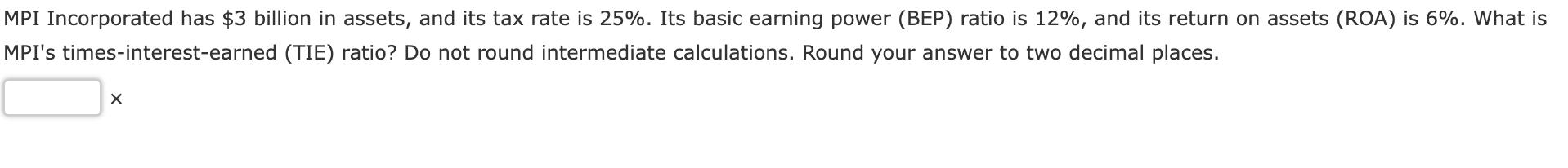

MPI Incorporated has $3 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 12%, and its return on assets (ROA) is 6%. What is MPI's times-interest-earned (TIE) ratio? Do not round intermediate calculations. Round your answer to two decimal places. X

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

1 RETURN ON ASSET ROA NET INCOME ASSETS 006 NET INCOME 3 BILLION net in... View full answer

Get step-by-step solutions from verified subject matter experts