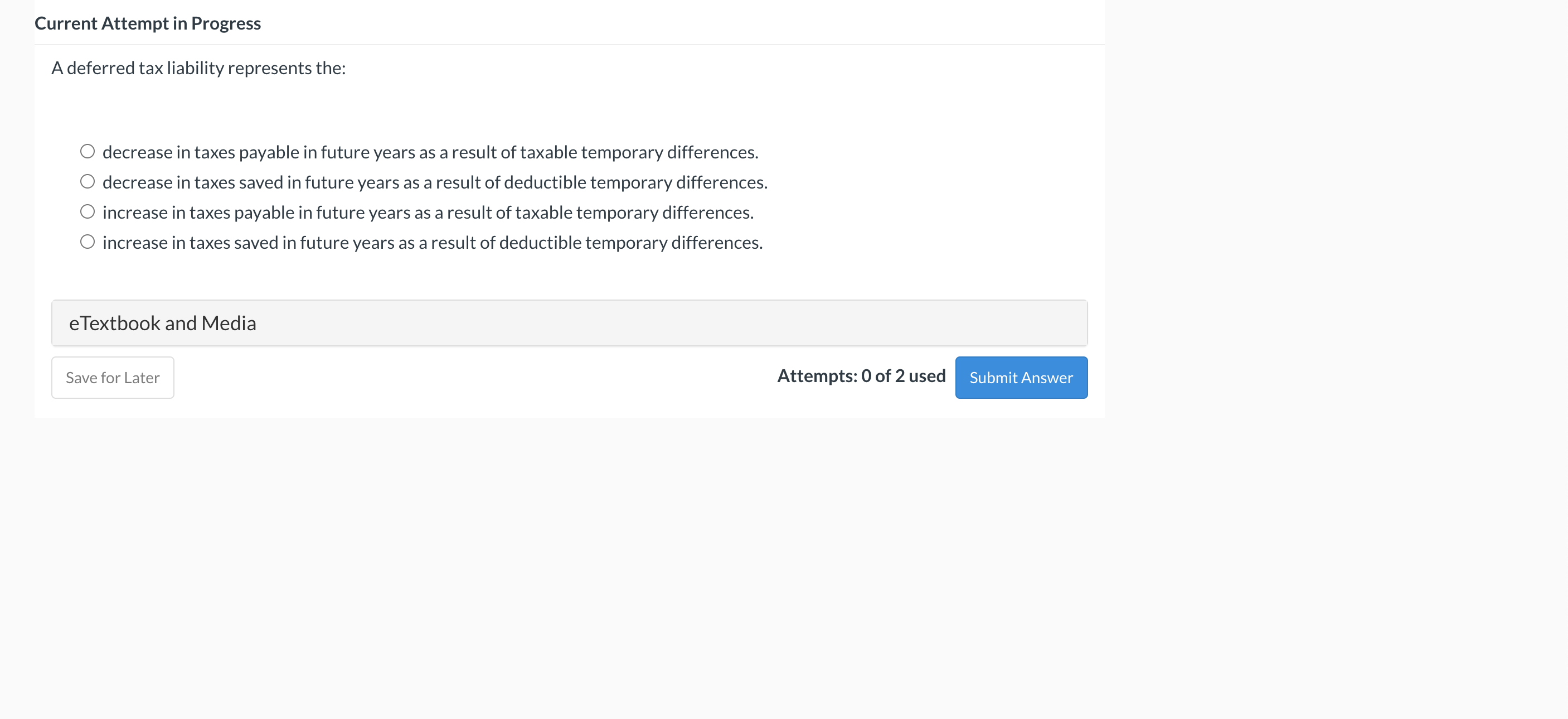

Question: Current Attempt in Progress A deferred tax liability represents the: 0 decrease in taxes payable in future years as a result of taxable temporary differences.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock