Question: Current Attempt in Progress Assume the following data for Sandhill Tattoo Parlor for the quarter ended September 30. Number of employees for third quarter: 7

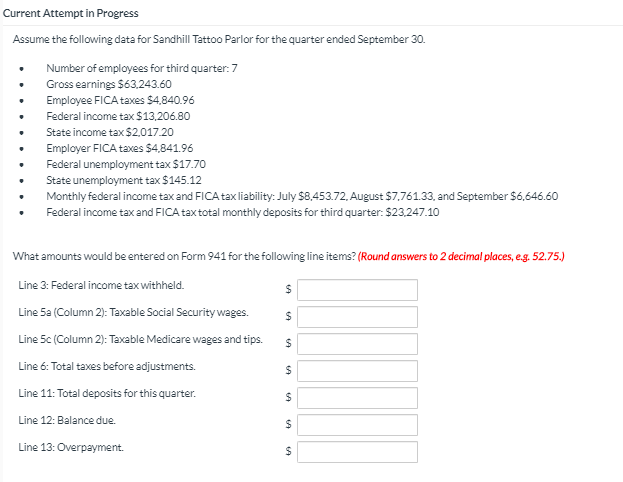

Current Attempt in Progress Assume the following data for Sandhill Tattoo Parlor for the quarter ended September 30. Number of employees for third quarter: 7 Gross earnings $63.243.60 Employee FICA taxes $4,840.96 Federal income tax $13,206.80 State income tax $2,01720 Employer FICA taxes $4.841.96 Federal unemployment tax $17.70 State unemployment tax $145.12 Monthly federal income tax and FICA tax liability: July $8.453.72 August $7,761.33 and September $6,646.60 Federal income tax and FICA tax total monthly deposits for third quarter: $23.247.10 What amounts would be entered on Form 941 for the following line items? (Round answers to 2 decimal places, e.g. 52.75.) Line 3: Federal income tax withheld. $ Line 5 Column 2): Taxable Social Security wages. Line 5c (Column 2): Taxable Medicare wages and tips. Line 6: Total taxes before adjustments. $ Line 11: Total deposits for this quarter. Line 12: Balance due $ $ $ $ $ $ Line 13: Overpayment $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts