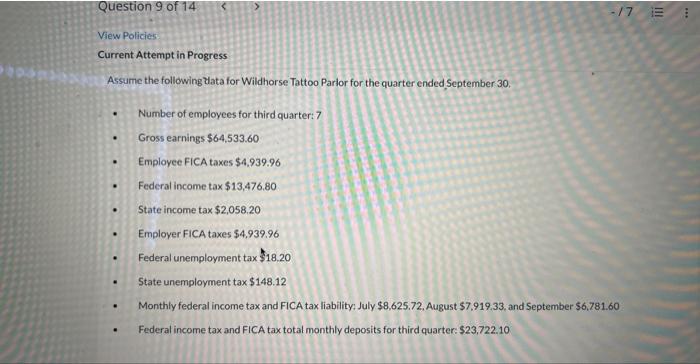

Question: View Policies: Current Attempt in Progress Assume the following 2data for Wildhorse Tattoo Parlor for the quarter ended September 30. - Number of employees for

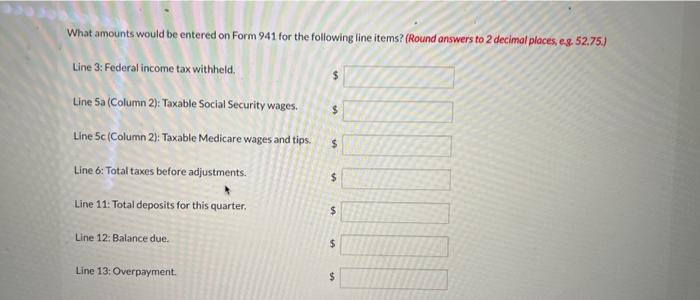

View Policies: Current Attempt in Progress Assume the following 2data for Wildhorse Tattoo Parlor for the quarter ended September 30. - Number of employees for third quarter: 7 - Gross earnings $64,533.60 - Employee FICA taxes $4.939.96 - Federal income tax $13,476.80 - State income tax $2,058.20 - Employer FICA taxes \$4,939.96 - Federal unemployment tax $18.20 - State unemployment tax $148.12 - Monthly federal income tax and FICA tax liability: July \$8,625.72. August \$7,919.33, and September \$6,781.60 - Federal income tax and FICA tax total monthly deposits for third quarter: $23,722.10 What amounts would be entered on Form 941 for the following line items? (Round answers to 2 decimal places, eg. 52.75.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts