Question: Current Attempt in Progress Below is a payroll sheet for Blue Company for the month of July. The company is allowed a ( 1

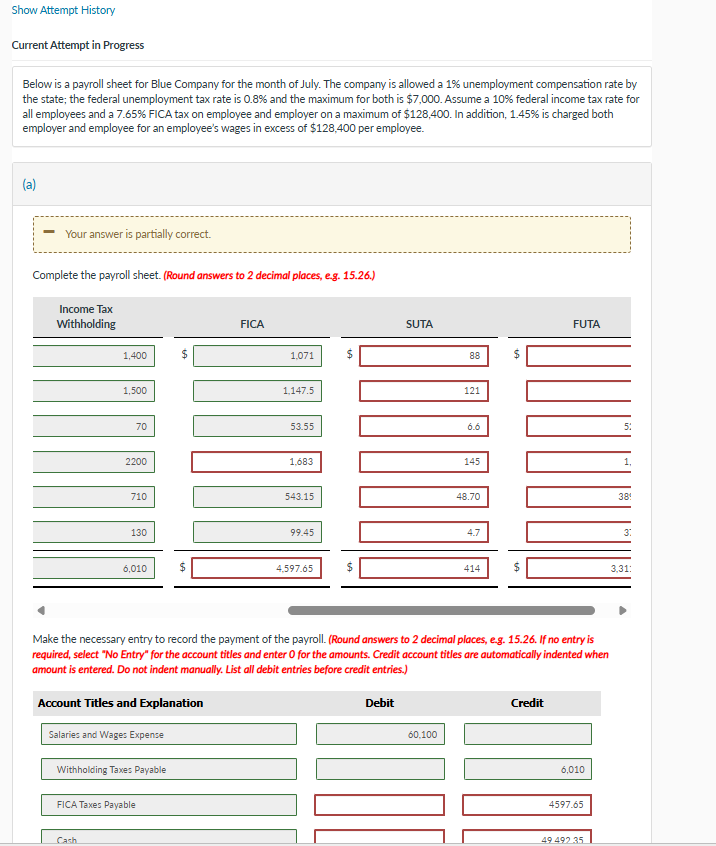

Current Attempt in Progress Below is a payroll sheet for Blue Company for the month of July. The company is allowed a unemployment compensation rate by the state; the federal unemployment tax rate is and the maximum for both is $ Assume a federal income tax rate for all employees and a FICA tax on employee and employer on a maximum of $ In addition, is charged both employer and employee for an employee's wages in excess of $ per employee. Your answer is partially correct. Complete the payroll sheet. Round answers to decimal places, egIncome Tax Withholding Make the necessary entry to record the payment of the payroll. Round answers to decimal places, eg If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries. Account Titles and Explanation Debit Credit Salaries and Wages Expense Withholding Taxes Payable FICA Taxes Payable Cash

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock