Question: Current Attempt in Progress Blue Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $53,900 in

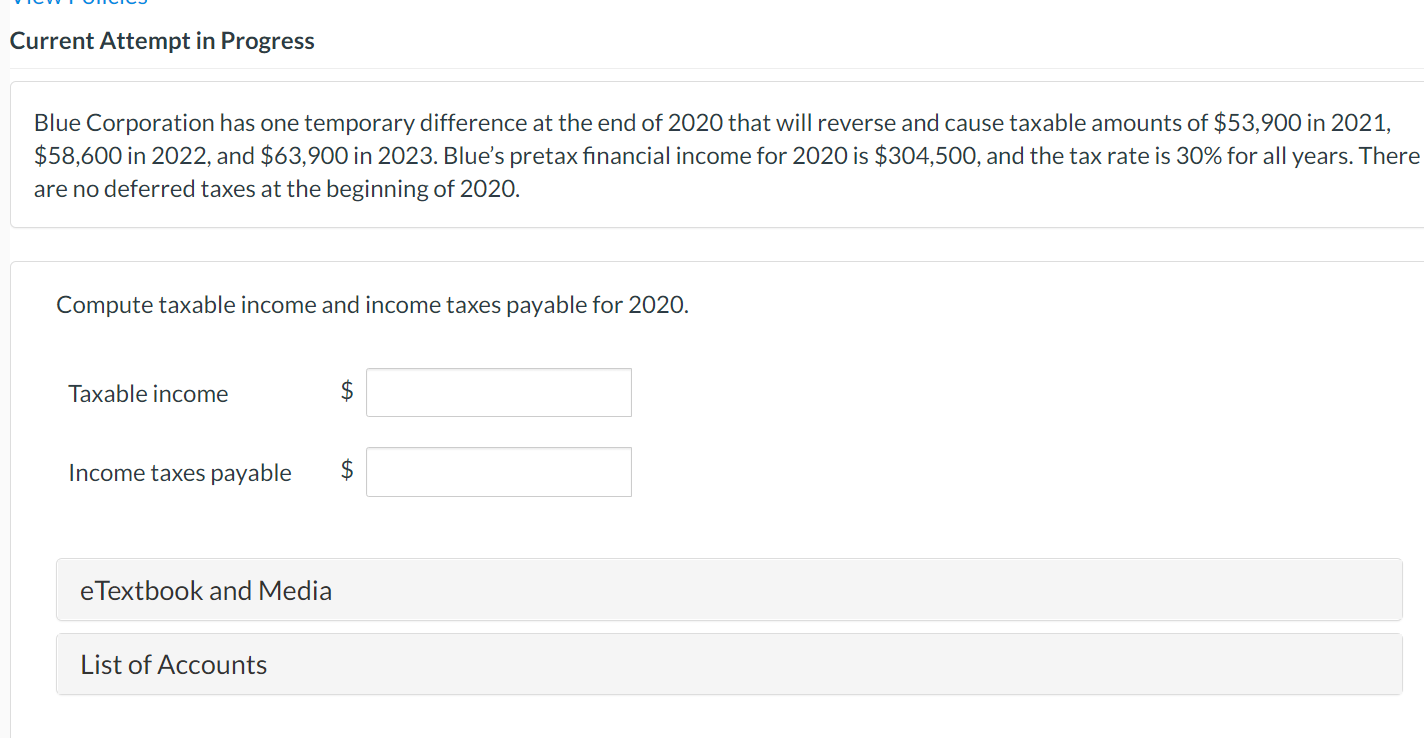

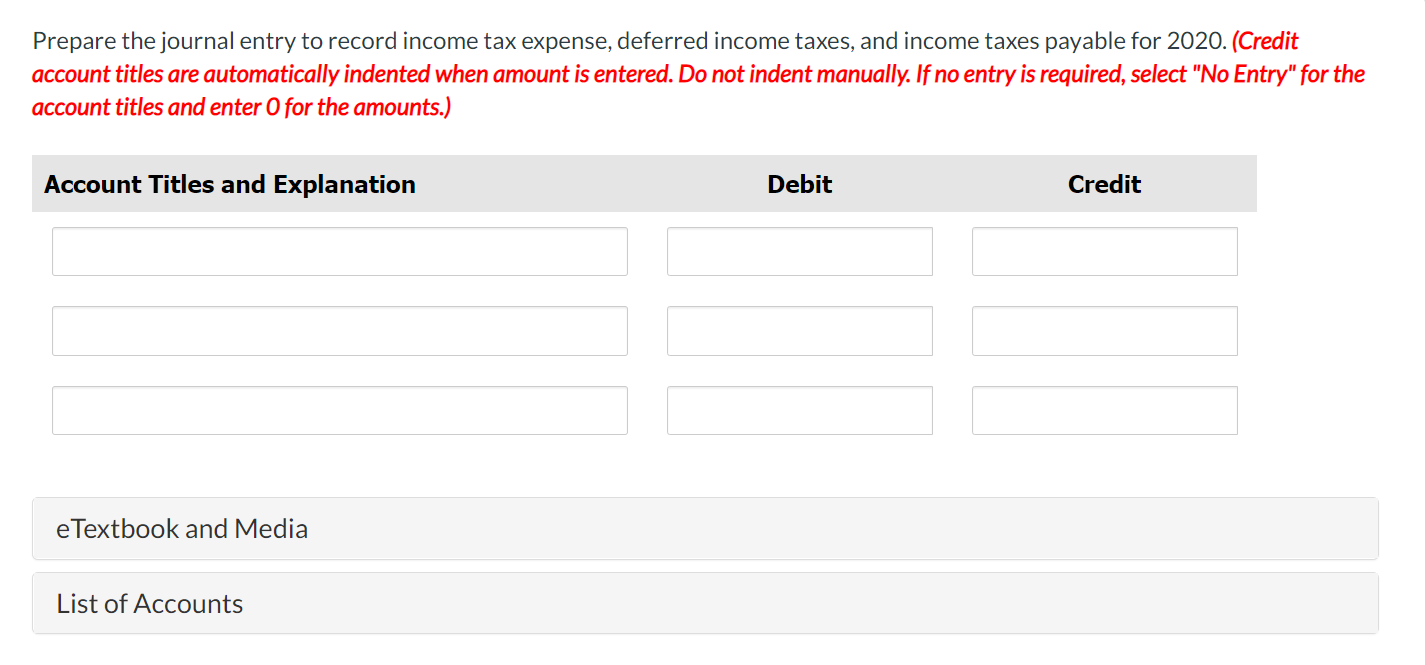

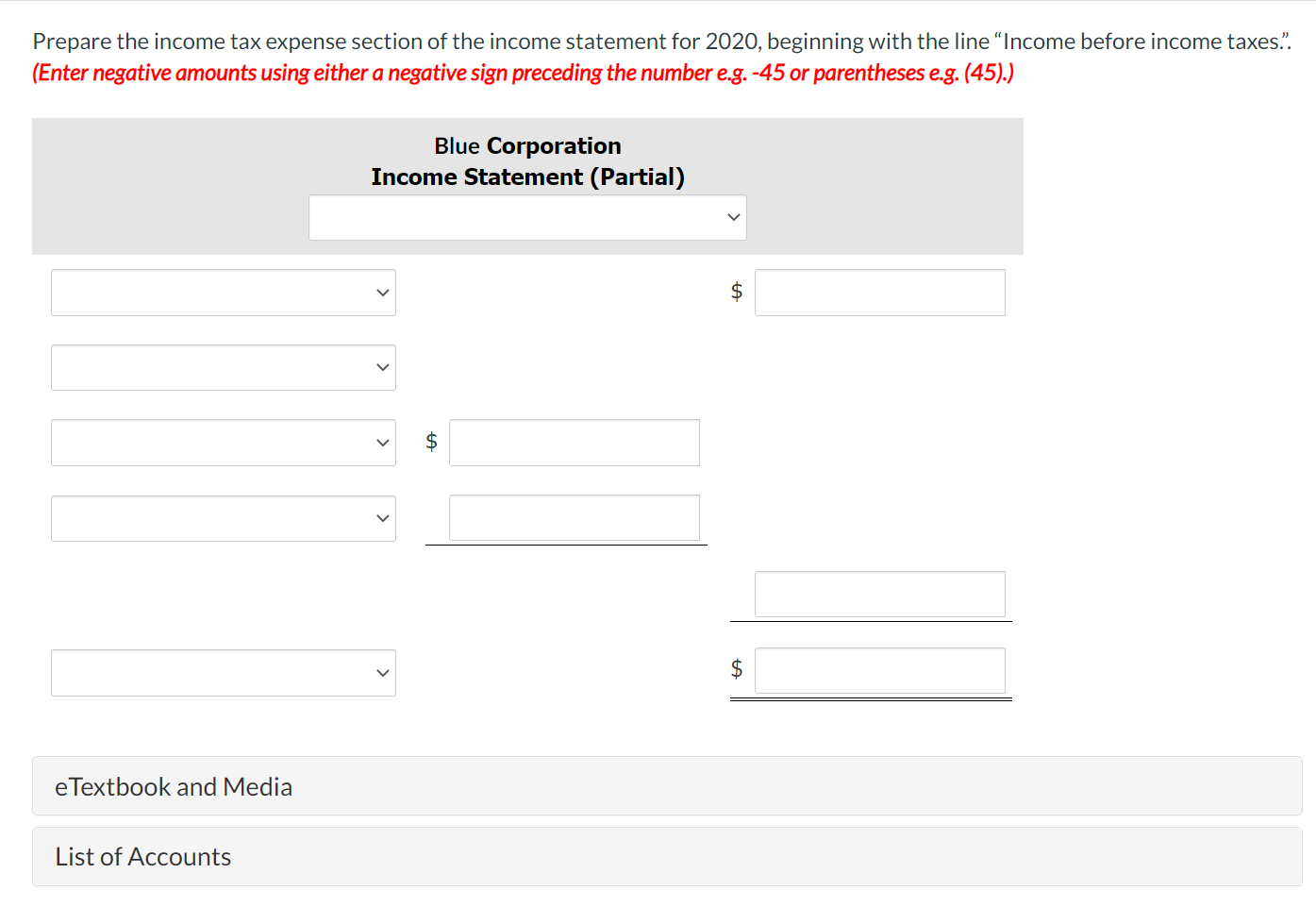

Current Attempt in Progress Blue Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $53,900 in 2021 , $58,600 in 2022 , and $63,900 in 2023 . Blue's pretax financial income for 2020 is $304,500, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2020. Compute taxable income and income taxes payable for 2020. Taxable income $ Income taxes payable eTextbook and Media List of Accounts Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020 . (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Prepare the income tax expense section of the income statement for 2020 , beginning with the line "Income before income taxes.". (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts