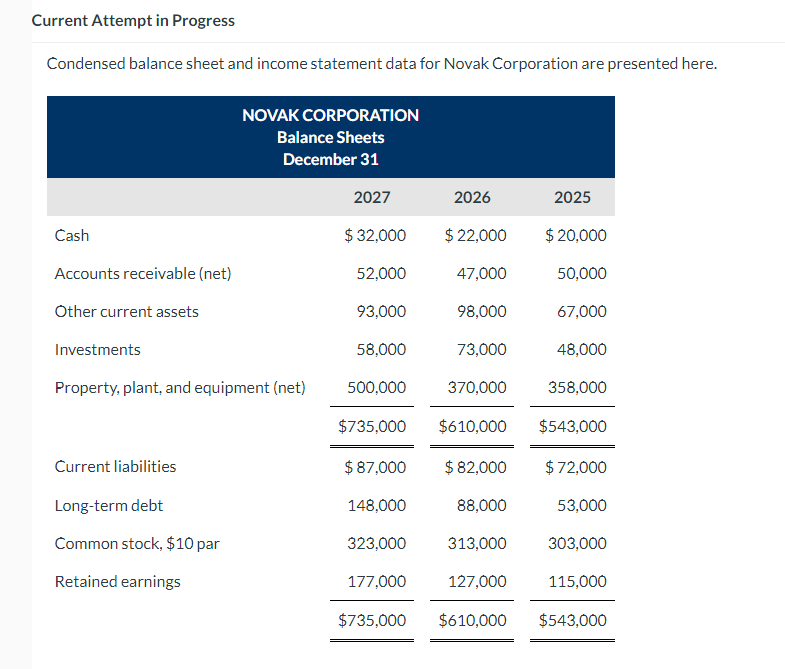

Question: Current Attempt in Progress Condensed balance sheet and income statement data for Novak Corporation are presented here. NOVAK CORPORATION Balance Sheets December 31 2027

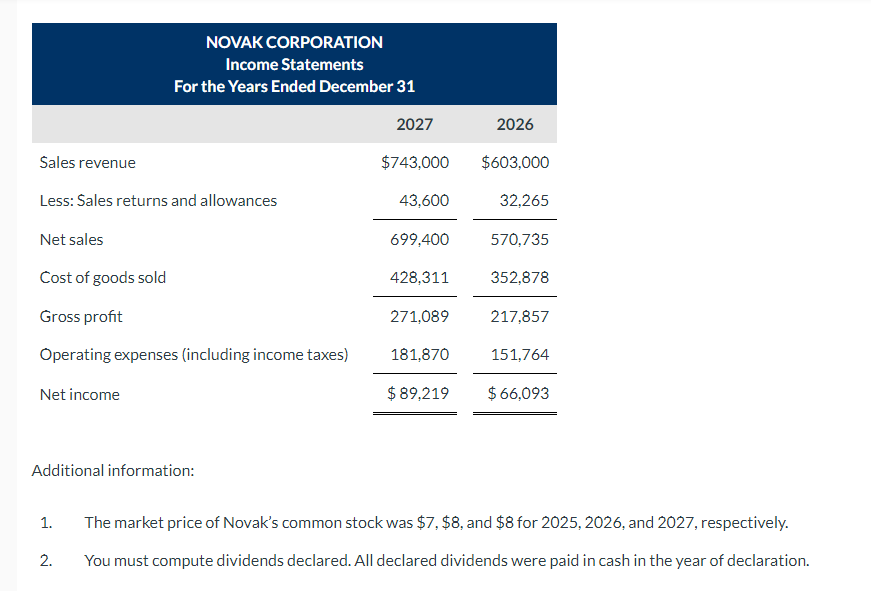

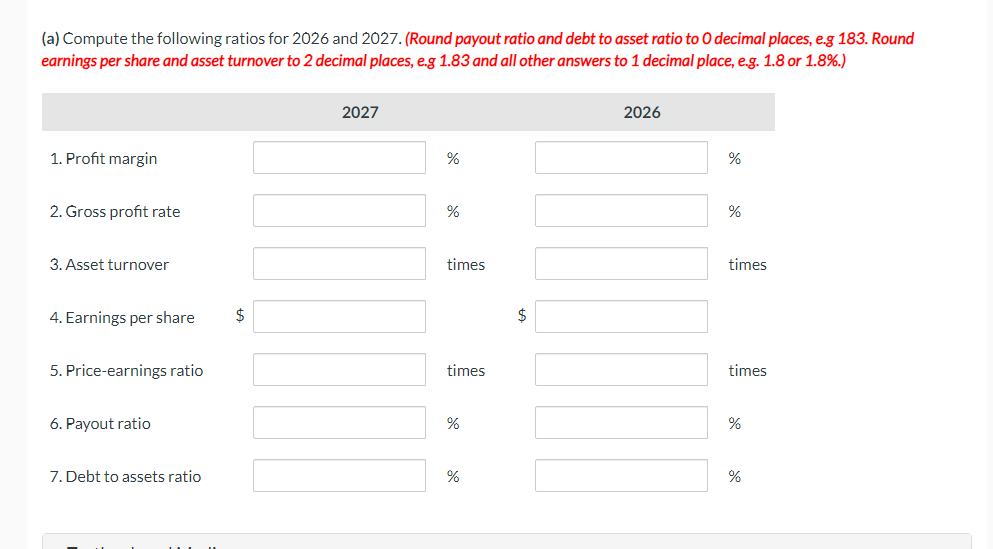

Current Attempt in Progress Condensed balance sheet and income statement data for Novak Corporation are presented here. NOVAK CORPORATION Balance Sheets December 31 2027 2026 2025 Cash $ 32,000 $22,000 $20,000 Accounts receivable (net) 52,000 47,000 50,000 Other current assets 93,000 98,000 67,000 Investments 58,000 73,000 48,000 Property, plant, and equipment (net) 500,000 370,000 358,000 $735,000 $610,000 $543,000 Current liabilities $87,000 $82,000 $72,000 Long-term debt 148,000 88,000 53,000 Common stock, $10 par 323,000 313,000 303,000 Retained earnings 177,000 127,000 115,000 $735,000 $610,000 $543,000 NOVAK CORPORATION Income Statements For the Years Ended December 31 2027 2026 Sales revenue $743,000 $603,000 Less: Sales returns and allowances 43,600 32,265 Net sales 699,400 570,735 Cost of goods sold 428,311 352,878 Gross profit 271,089 217,857 Operating expenses (including income taxes) 181,870 151,764 Net income $ 89,219 $66,093 Additional information: The market price of Novak's common stock was $7, $8, and $8 for 2025, 2026, and 2027, respectively. 1. 2. You must compute dividends declared. All declared dividends were paid in cash in the year of declaration. (a) Compute the following ratios for 2026 and 2027. (Round payout ratio and debt to asset ratio to O decimal places, e.g 183. Round earnings per share and asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 1.8%.) 1. Profit margin 2. Gross profit rate 3. Asset turnover 4. Earnings per share 5. Price-earnings ratio 6. Payout ratio 2027 % % times times % $ 2026 % % times times % 7. Debt to assets ratio % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts