Question: Current Attempt in Progress Crane Electrical Company's financial statements indicated that the company had earnings before interest and taxes of $791,000.00. The interest rate on

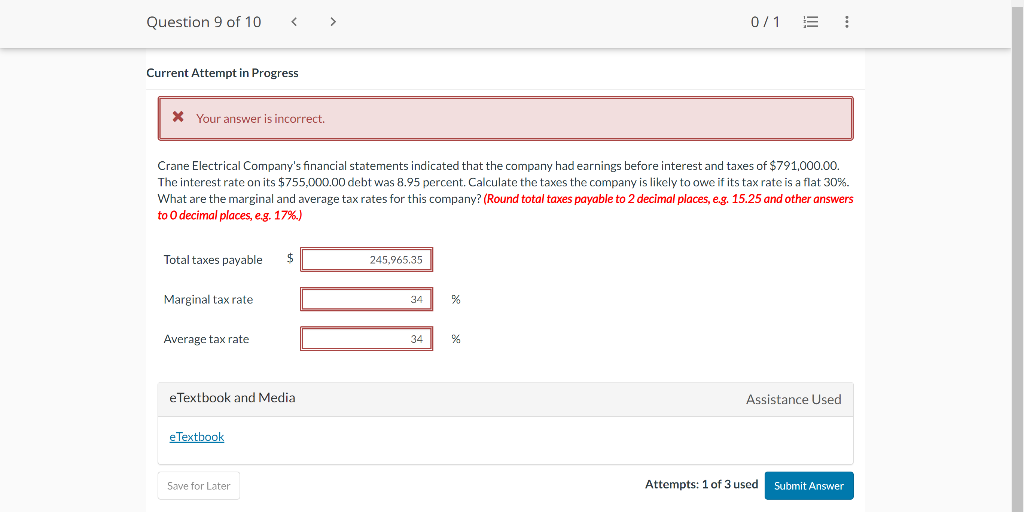

Current Attempt in Progress Crane Electrical Company's financial statements indicated that the company had earnings before interest and taxes of $791,000.00. The interest rate on its $755,000.00 debt was 8.95 percent. Calculate the taxes the company is likely to owe if its tax rate is a flat 30%. What are the marginal and average tax rates for this company? (Round total taxes payable to 2 decimal places, e.g. 15.25 and other answers to 0 decimal places, e.g. 17\%.) Total taxes payable $ Marginal tax rate % Average tax rate % eTextbook and Media Assistance Used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts