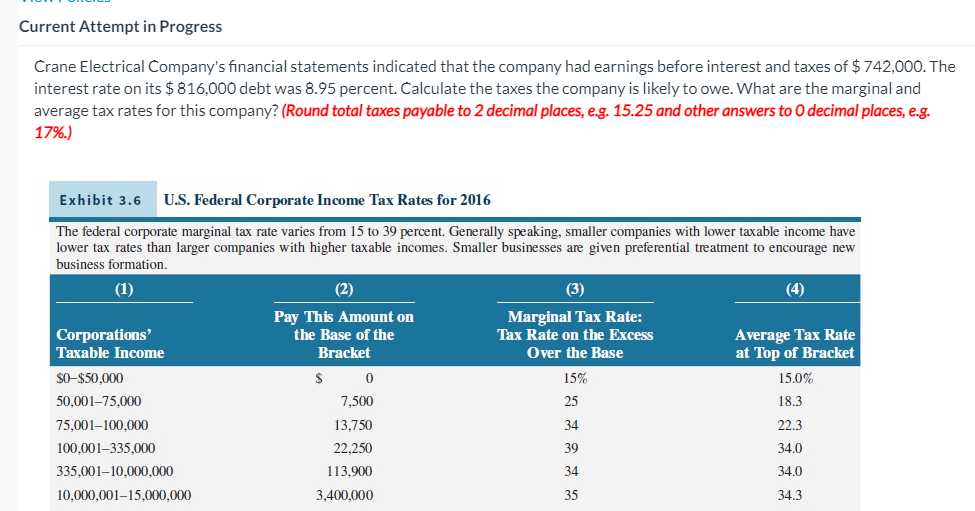

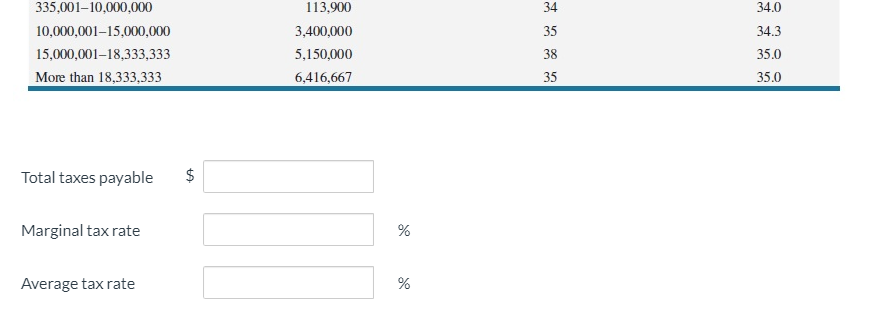

Question: i need help Current Attempt in Progress Crane Electrical Company's nancial statements indicated that the company had earnings before interest and taxes of $ 742,000.The

i need help

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock