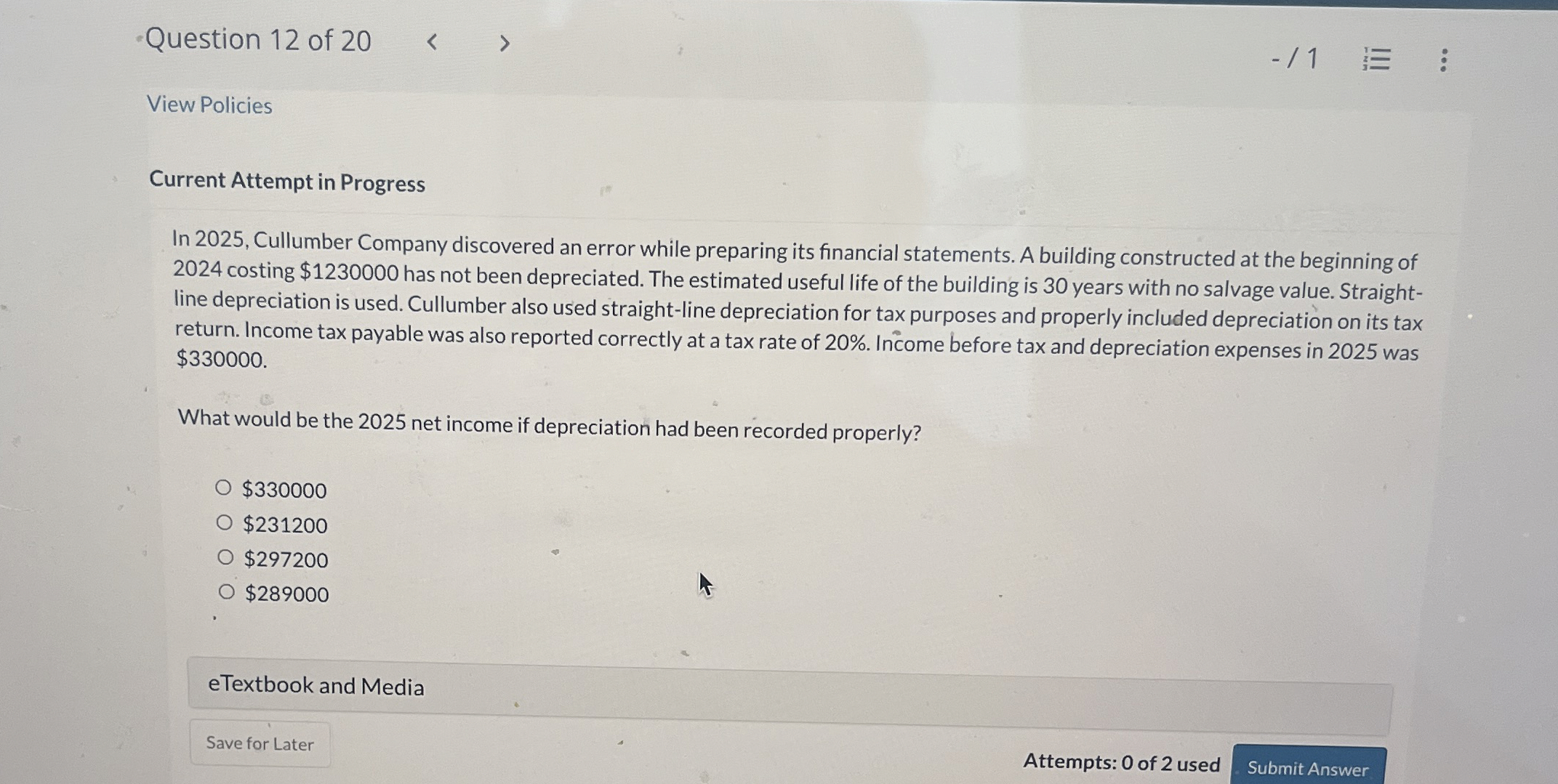

Question: Current Attempt in Progress In 2 0 2 5 , Cullumber Company discovered an error while preparing its financial statements. A building constructed at the

Current Attempt in Progress

In Cullumber Company discovered an error while preparing its financial statements. A building constructed at the beginning of

costing $ has not been depreciated. The estimated useful life of the building is years with no salvage value. Straight

line depreciation is used. Cullumber also used straightline depreciation for tax purposes and properly included depreciation on its tax

return. Income tax payable was also reported correctly at a tax rate of Income before tax and depreciation expenses in was

$

What would be the net income if depreciation had been recorded properly?

$

$

$

$

eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock