Question: In 2019, Oriole Ltd. issued $48,000 of 9% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had

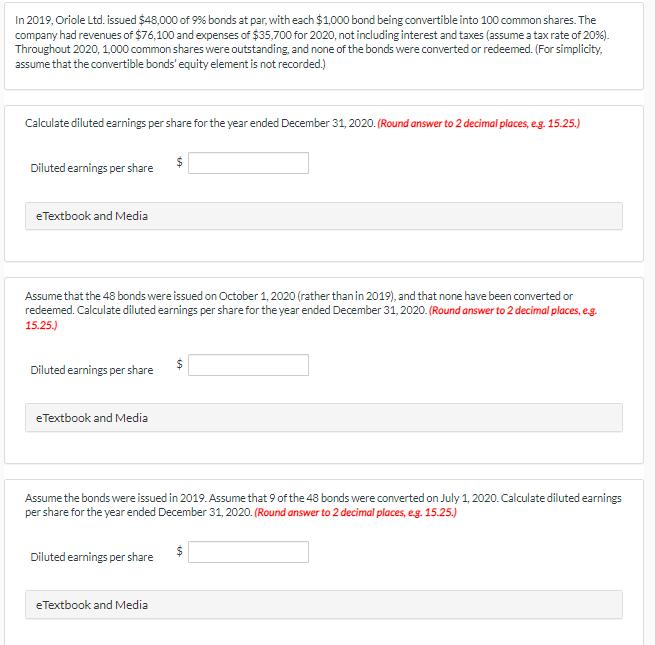

In 2019, Oriole Ltd. issued $48,000 of 9% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had revenues of $76,100 and expenses of $35,700 for 2020, not including interest and taxes (assume atax rate of 20%). Throughout 2020, 1,000 common shares were outstanding, and none of the bonds were converted or redeemed. (For simplicity, assume that the convertible bonds' equity element is not recorded.) Calculate diluted earnings per share for the year ended December 31, 2020. (Round answer to 2 decimal places, eg. 15.25.) Diluted earnings per share eTextbook and Media Assume that the 48 bonds were issued on October 1, 2020 (rather than in 2019), and that none have been converted or redeemed. Calculate diluted earnings per share for the year ended December 31, 2020. (Round answer to 2 decimal places, eg. 15.25.) Diluted earnings per share eTextbook and Media Assume the bonds were issued in 2019. Assume that 9 of the 48 bonds were converted on July 1, 2020. Calculate diluted earnings per share for the year ended December 31, 2020. (Round answer to 2 decimal places, eg. 15.25.) Diluted earmings per share eTextbook and Media

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

1 Diluted Earnings Per Share Adjusted Income Weighted Average No of Common Shares outstanding ... View full answer

Get step-by-step solutions from verified subject matter experts