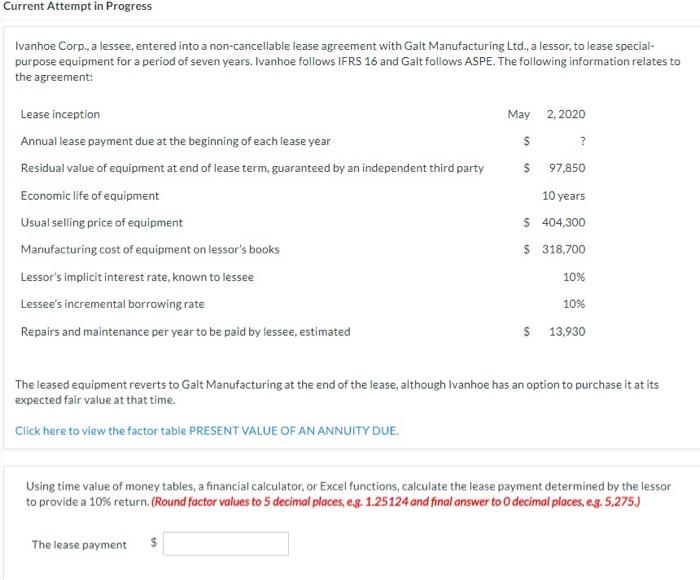

Question: Current Attempt in Progress Ivanhoe Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special- purpose equipment

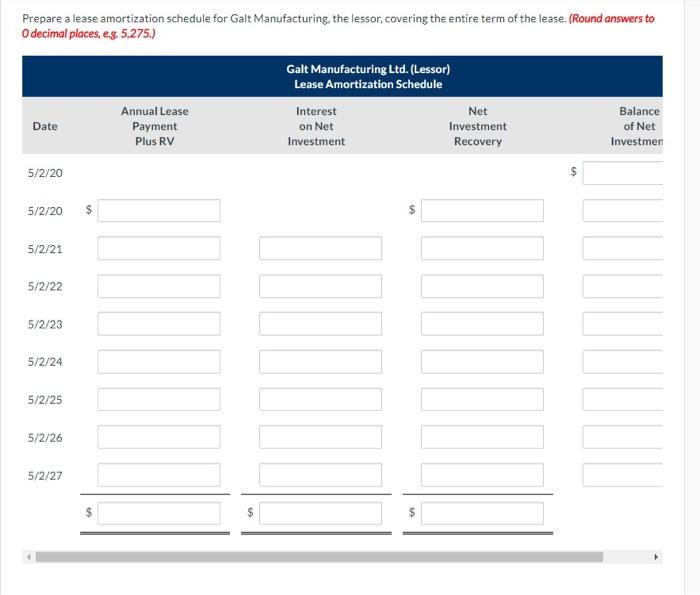

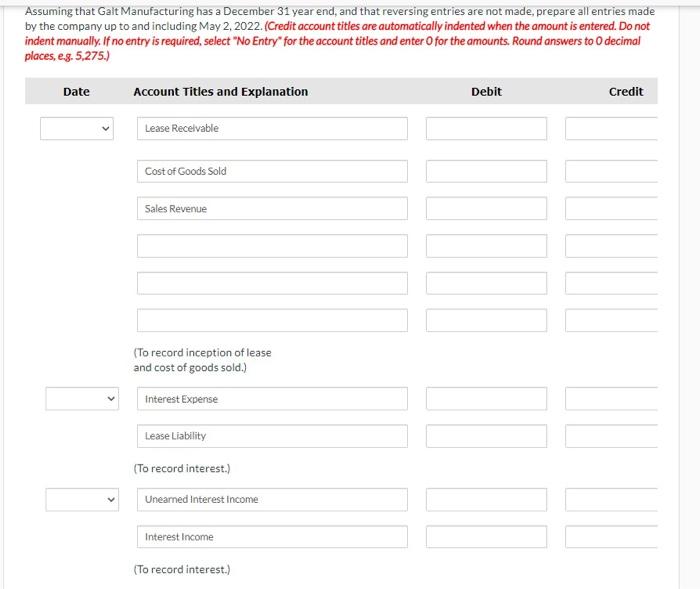

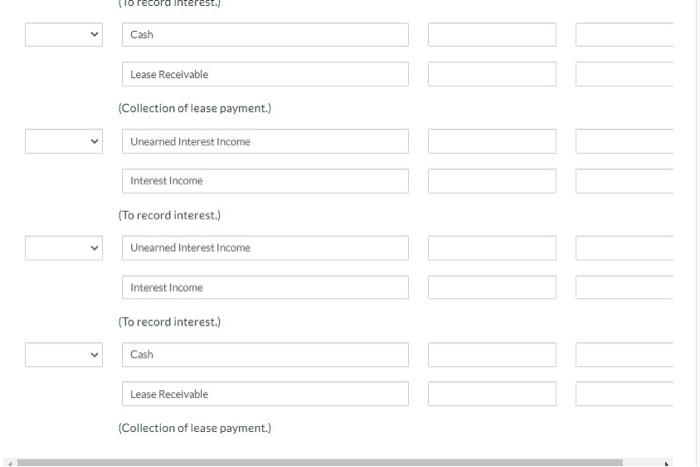

Current Attempt in Progress Ivanhoe Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special- purpose equipment for a period of seven years. Ivanhoe follows IFRS 16 and Galt follows ASPE. The following information relates to the agreement: May 2, 2020 S ? Lease inception Annual lease payment due at the beginning of each lease year Residual value of equipment at end of lease term, guaranteed by an independent third party Economic life of equipment Usual selling price of equipment Manufacturing cost of equipment on lessor's books Lessor's implicit interest rate, known to lessee Lessee's incremental borrowing rate Repairs and maintenance per year to be paid by lessee, estimated $ 97,850 10 years $ 404,300 $ 318,700 1096 10% $ 13,930 The leased equipment reverts to Galt Manufacturing at the end of the lease, although Ivanhoe has an option to purchase it at its expected fair value at that time. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using time value of money tables, a financial calculator, or Excel functions, calculate the lease payment determined by the lessor to provide a 10% return. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to decimal places, e.g. 5,275.) The lease payment $ $ Prepare a lease amortization schedule for Galt Manufacturing, the lessor, covering the entire term of the lease. (Round answers to O decimal places, e.g. 5,275.) Annual Lease Payment Plus RV Galt Manufacturing Ltd. (Lessor) Lease Amortization Schedule Interest Net on Net Investment Investment Recovery Date Balance of Net Investmen 5/2/20 5/2/20 $ $ 5/2/21 5/2/22 5/2/23 5/2/24 5/2/25 5/2/26 5/2/27 a Assuming that Galt Manufacturing has a December 31 year end, and that reversing entries are not made, prepare all entries made by the company up to and including May 2, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Lease Recevable Cost of Goods Sold Sales Revenue (To record inception of lease and cost of goods sold.) Interest Expense Lease Liability (To record interest.) Unearned Interest Income Interest Income (To record interest.) lo record interest.) Cash Lease Receivable (Collection of lease payment.) Unearned Interest Income Interest Income (To record interest.) Unearned Interest Income Interest Income (To record interest.) Cash Lease Receivable (Collection of lease payment.) Current Attempt in Progress Ivanhoe Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special- purpose equipment for a period of seven years. Ivanhoe follows IFRS 16 and Galt follows ASPE. The following information relates to the agreement: May 2, 2020 S ? Lease inception Annual lease payment due at the beginning of each lease year Residual value of equipment at end of lease term, guaranteed by an independent third party Economic life of equipment Usual selling price of equipment Manufacturing cost of equipment on lessor's books Lessor's implicit interest rate, known to lessee Lessee's incremental borrowing rate Repairs and maintenance per year to be paid by lessee, estimated $ 97,850 10 years $ 404,300 $ 318,700 1096 10% $ 13,930 The leased equipment reverts to Galt Manufacturing at the end of the lease, although Ivanhoe has an option to purchase it at its expected fair value at that time. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using time value of money tables, a financial calculator, or Excel functions, calculate the lease payment determined by the lessor to provide a 10% return. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to decimal places, e.g. 5,275.) The lease payment $ $ Prepare a lease amortization schedule for Galt Manufacturing, the lessor, covering the entire term of the lease. (Round answers to O decimal places, e.g. 5,275.) Annual Lease Payment Plus RV Galt Manufacturing Ltd. (Lessor) Lease Amortization Schedule Interest Net on Net Investment Investment Recovery Date Balance of Net Investmen 5/2/20 5/2/20 $ $ 5/2/21 5/2/22 5/2/23 5/2/24 5/2/25 5/2/26 5/2/27 a Assuming that Galt Manufacturing has a December 31 year end, and that reversing entries are not made, prepare all entries made by the company up to and including May 2, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Lease Recevable Cost of Goods Sold Sales Revenue (To record inception of lease and cost of goods sold.) Interest Expense Lease Liability (To record interest.) Unearned Interest Income Interest Income (To record interest.) lo record interest.) Cash Lease Receivable (Collection of lease payment.) Unearned Interest Income Interest Income (To record interest.) Unearned Interest Income Interest Income (To record interest.) Cash Lease Receivable (Collection of lease payment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts