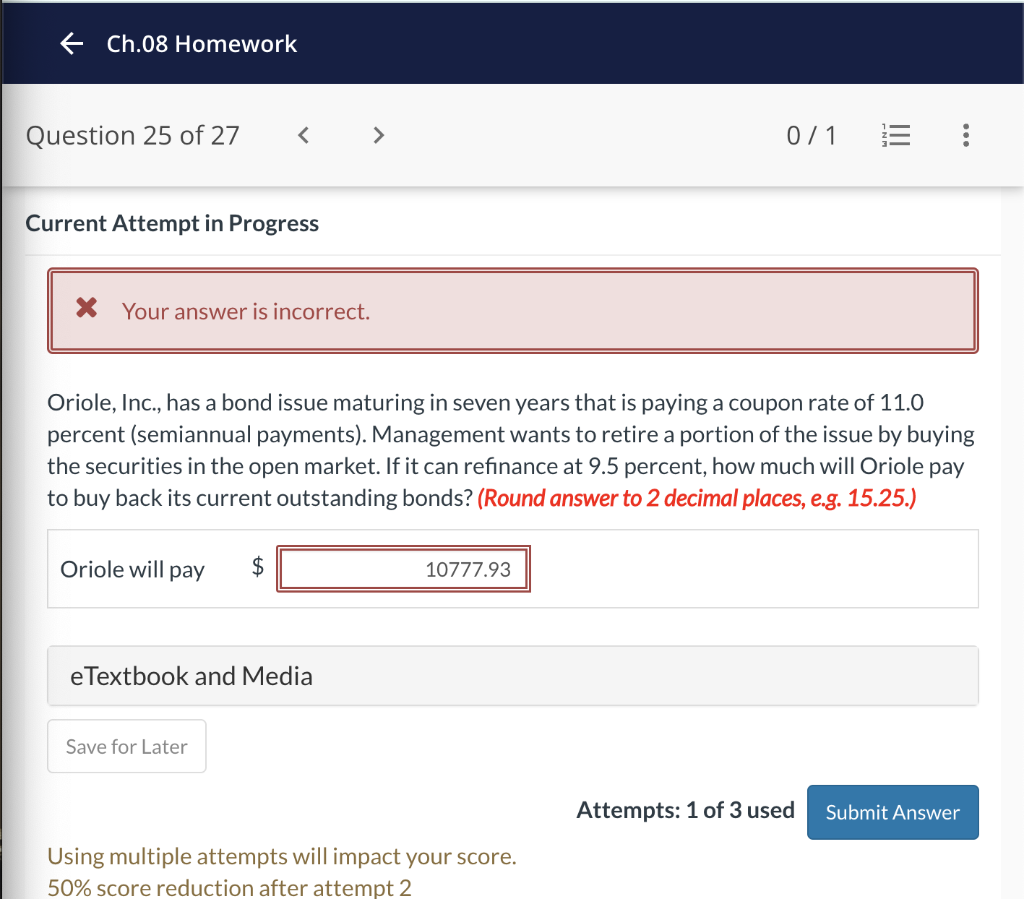

Question: Current Attempt in Progress Oriole, Inc., has a bond issue maturing in seven years that is paying a coupon rate of 11.0 percent (semiannual payments).

Current Attempt in Progress Oriole, Inc., has a bond issue maturing in seven years that is paying a coupon rate of 11.0 percent (semiannual payments). Management wants to retire a portion of the issue by buying the securities in the open market. If it can refinance at 9.5 percent, how much will Oriole pay to buy back its current outstanding bonds? (Round answer to 2 decimal places, e.g. 15.25.) Oriole will pay $ Using multiple attempts will impact your score. 50% score reduction after attempt 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts