Question: Current Attempt in Progress Pina Colada Corp. purchased depreciable assets costing $725,000 on January 2, 2023. For tax purposes, the company uses CCA in

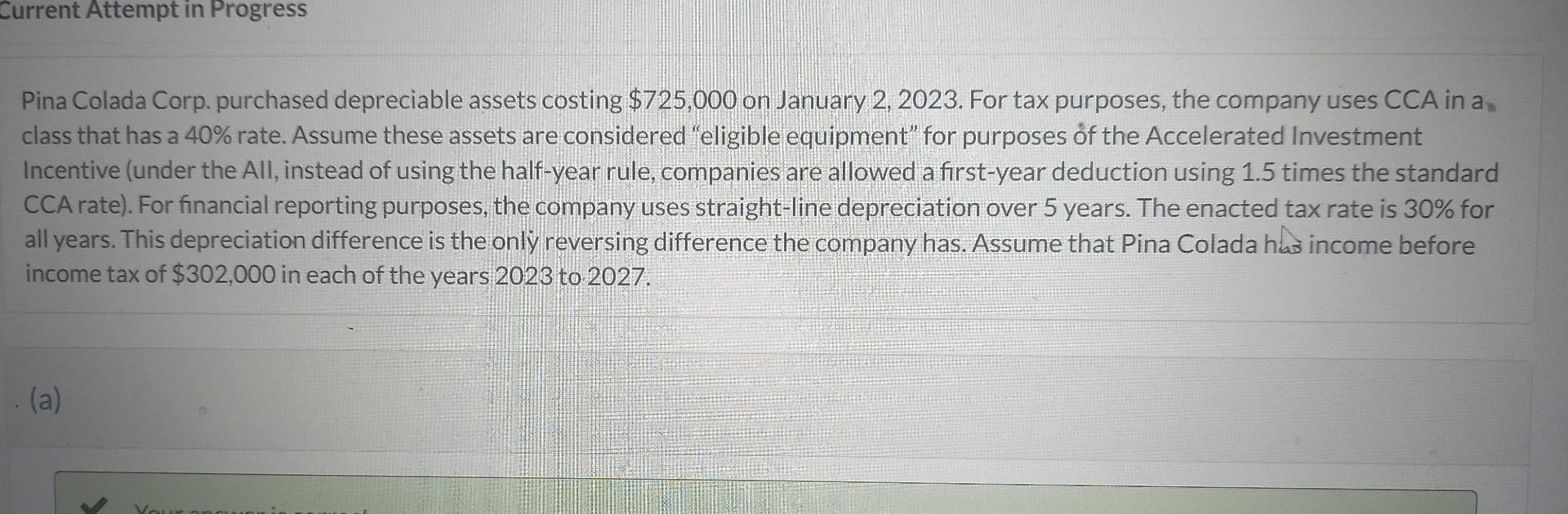

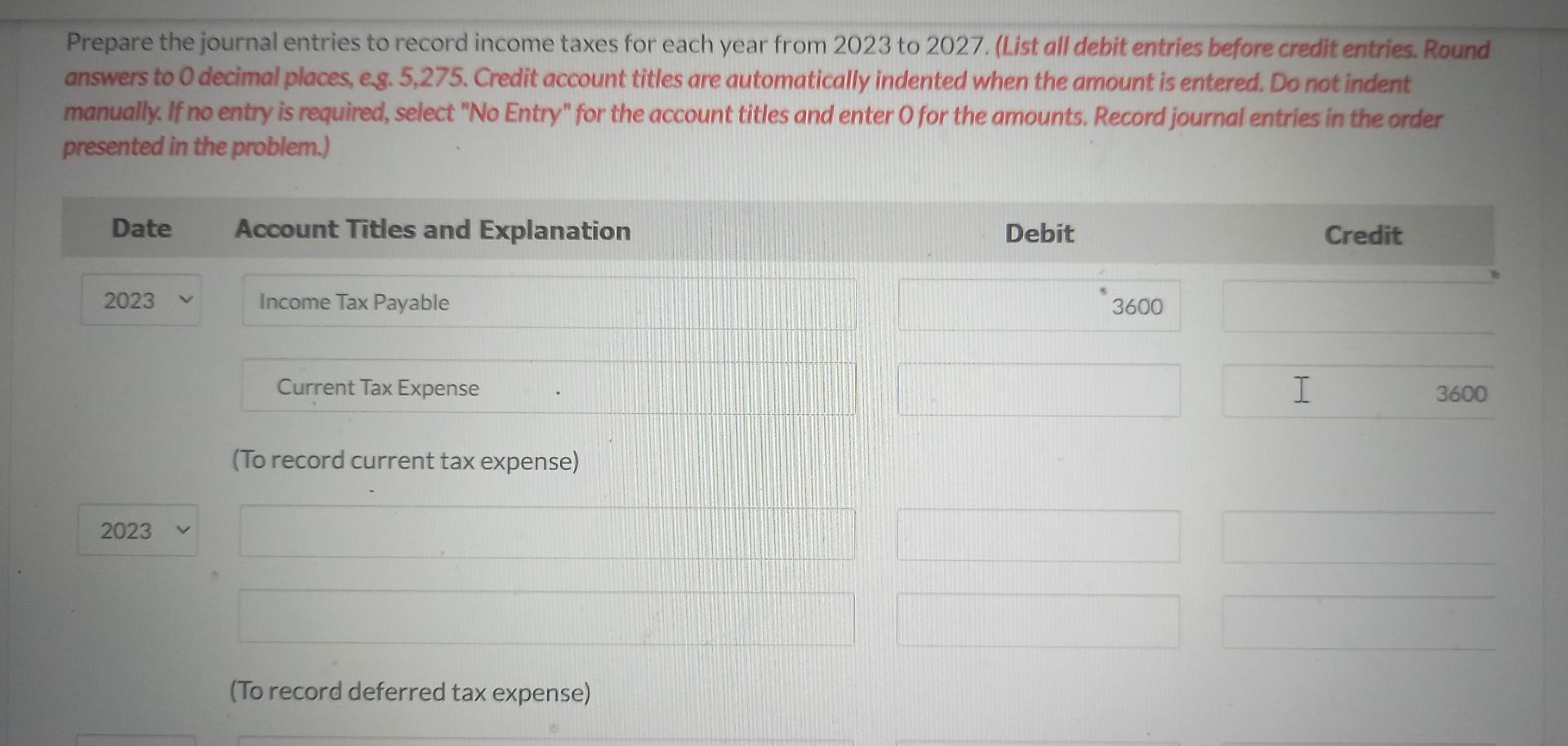

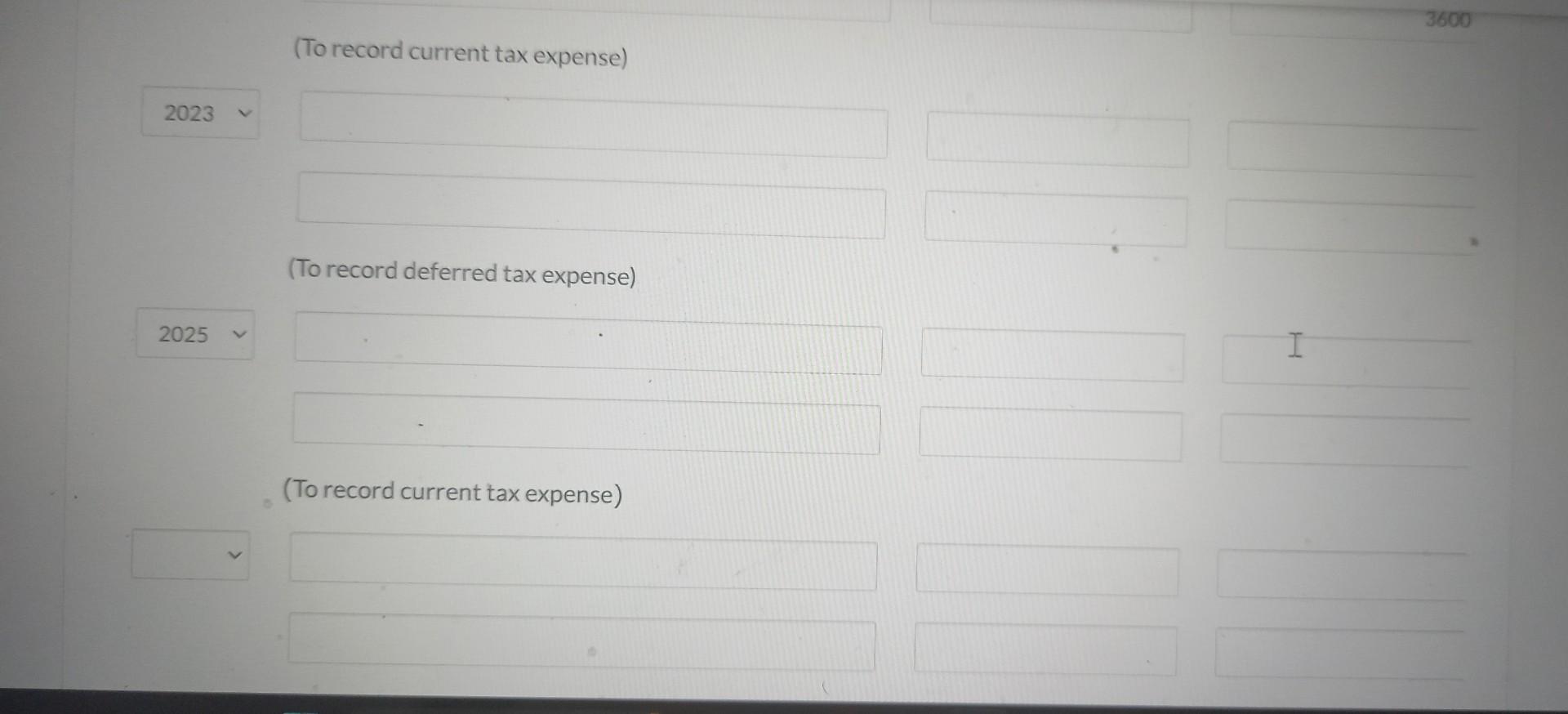

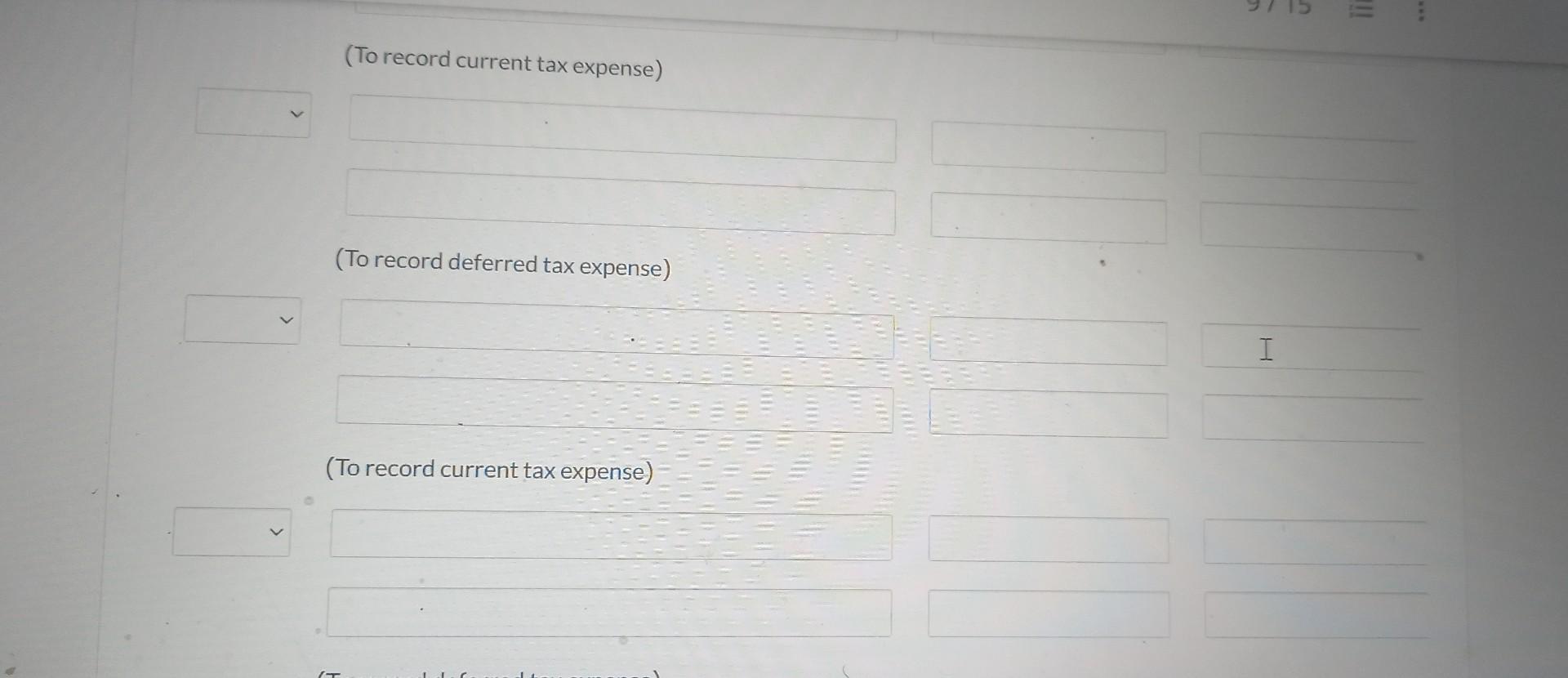

Current Attempt in Progress Pina Colada Corp. purchased depreciable assets costing $725,000 on January 2, 2023. For tax purposes, the company uses CCA in a class that has a 40% rate. Assume these assets are considered "eligible equipment" for purposes of the Accelerated Investment Incentive (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). For financial reporting purposes, the company uses straight-line depreciation over 5 years. The enacted tax rate is 30% for all years. This depreciation difference is the only reversing difference the company has. Assume that Pina Colada has income before income tax of $302,000 in each of the years 2023 to 2027. (a) Prepare the journal entries to record income taxes for each year from 2023 to 2027. (List all debit entries before credit entries. Round answers to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation 2023 V Income Tax Payable 2023 Current Tax Expense (To record current tax expense) (To record deferred tax expense) Debit 3600 Credit I 3600 2023 2025 (To record current tax expense) (To record deferred tax expense) (To record current tax expense) 3600 (To record current tax expense) (To record deferred tax expense) I (To record current tax expense) (To record current tax expense) > (To record deferred tax expense) (To record current tax expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts