Question: Current Attempt in Progress Please view the following video before answering this question Video Solution: 09.03-PRO12 Raytheon wishes to use an automated environmental chamber in

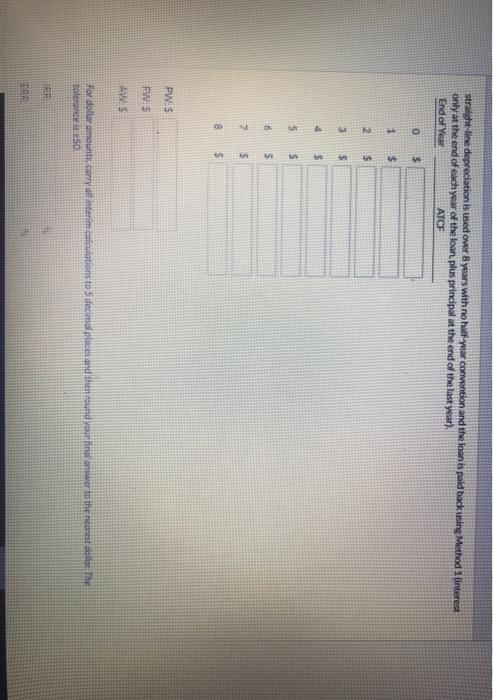

Current Attempt in Progress Please view the following video before answering this question Video Solution: 09.03-PRO12 Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,200,000, $650,000 of which is borrowed at 11% for 5 years, and will have a salvage value of $300,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income taxes are 25%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the chamber is kept for 8 years. After-tax MARR is 10%. Determine for each year the ATCF and the PW.FW.AW, IRR, and ERR for the investment if: Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. straight-line depreciation is used over 8 years with no half-year convention and the loan is paid back using Method 1(interest only at the end of each year of the loan, plus principal at the end of the last year) End of Year ATCE 0 $ 1 $ 2 $ 3 $ 4 S 5 S 6 $ 7 $ B 5 PWS FWS AVIS For dollar amounts carryallerim calculations to 5 decimo place and then und einer wertothered. The tolerance 50. Current Attempt in Progress Please view the following video before answering this question Video Solution: 09.03-PRO12 Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,200,000, $650,000 of which is borrowed at 11% for 5 years, and will have a salvage value of $300,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income taxes are 25%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the chamber is kept for 8 years. After-tax MARR is 10%. Determine for each year the ATCF and the PW.FW.AW, IRR, and ERR for the investment if: Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. straight-line depreciation is used over 8 years with no half-year convention and the loan is paid back using Method 1(interest only at the end of each year of the loan, plus principal at the end of the last year) End of Year ATCE 0 $ 1 $ 2 $ 3 $ 4 S 5 S 6 $ 7 $ B 5 PWS FWS AVIS For dollar amounts carryallerim calculations to 5 decimo place and then und einer wertothered. The tolerance 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts