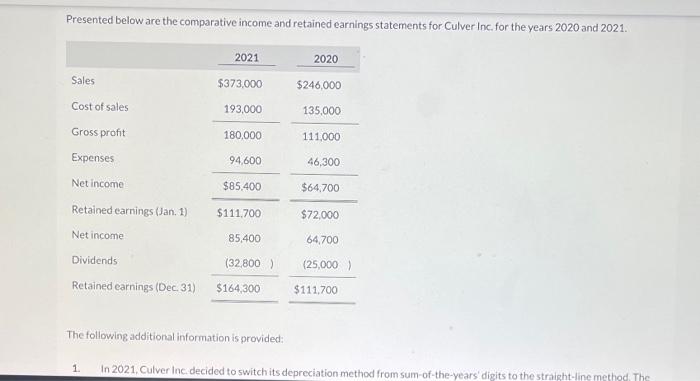

Question: Current Attempt in Progress Presented below are the comparative income and retained earnings statements for Culver Inc. for the years 2020 and 2021. Presented below

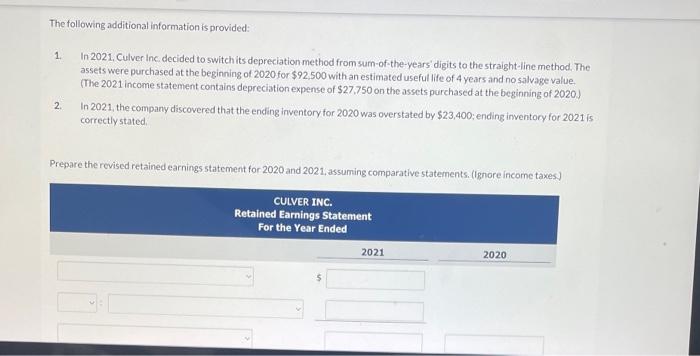

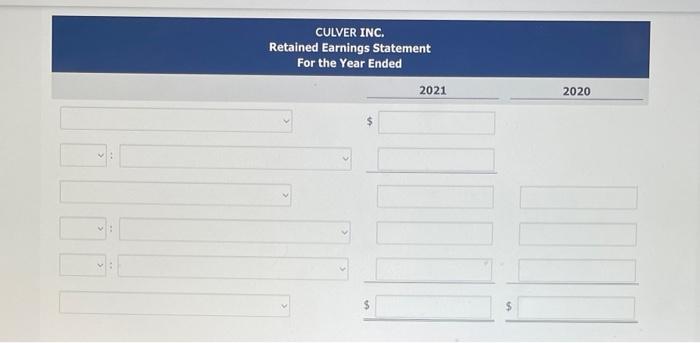

Presented below are the comparative income and retained earnings statements for Culver Inc for the years 2020 and 2021. The following additional information is provided: 1. In 2021, Culver Inc decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The The following additional information is provided: 1. In 2021. Culver inc decided to switch its depreciation method from sum-of-the-years digits to the straight-line method. The assets were purchased at the beginning of 2020 for $92,500 with an estimated useful life of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $27,750 on the assets purchased at the beginning of 2020 ) 2. In 2021, the company discovered that the ending inventory for 2020 was overstated by $23,400; ending inventory for 2021 is correctly stated. Prepare the revised retained earnings statement for 2020 and 2021 , assuming comparative statements. (Ignore income taxes) CULVER INC. Retained Earnings Statement For the Year Ended

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts