Question: Current Attempt in Progress Presented below are two independent situations. ( a ) Wildhorse Co . sold $ 1 , 9 3 0 , 0

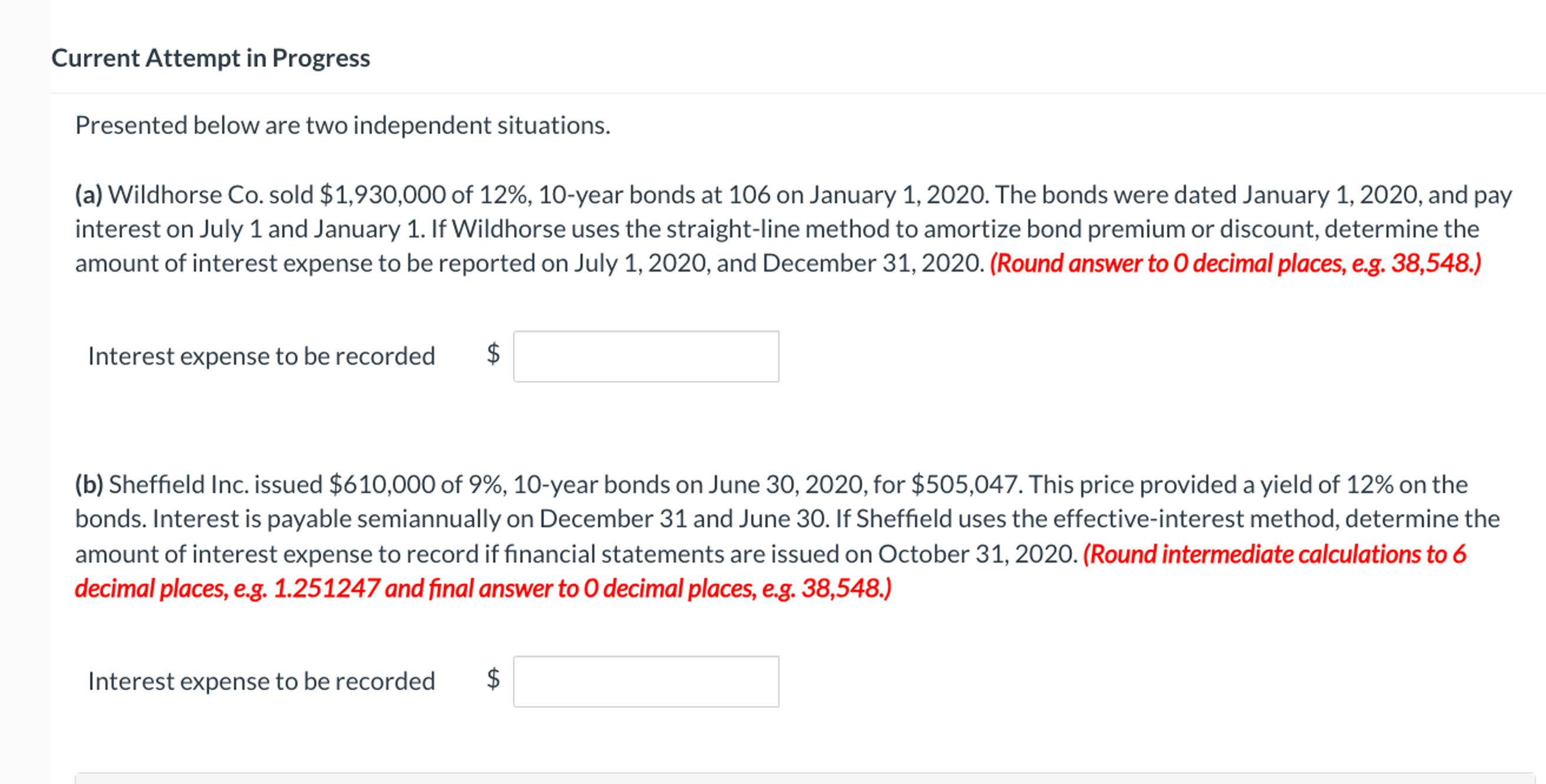

Current Attempt in Progress

Presented below are two independent situations.

a Wildhorse Co sold $ of year bonds at on January The bonds were dated January and pay

interest on July and January If Wildhorse uses the straightline method to amortize bond premium or discount, determine the

amount of interest expense to be reported on July and December Round answer to decimal places, eg

Interest expense to be recorded $

b Sheffield Inc. issued $ of year bonds on June for $ This price provided a yield of on the

bonds. Interest is payable semiannually on December and June If Sheffield uses the effectiveinterest method, determine the

amount of interest expense to record if financial statements are issued on October Round intermediate calculations to

decimal places, eg and final answer to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock