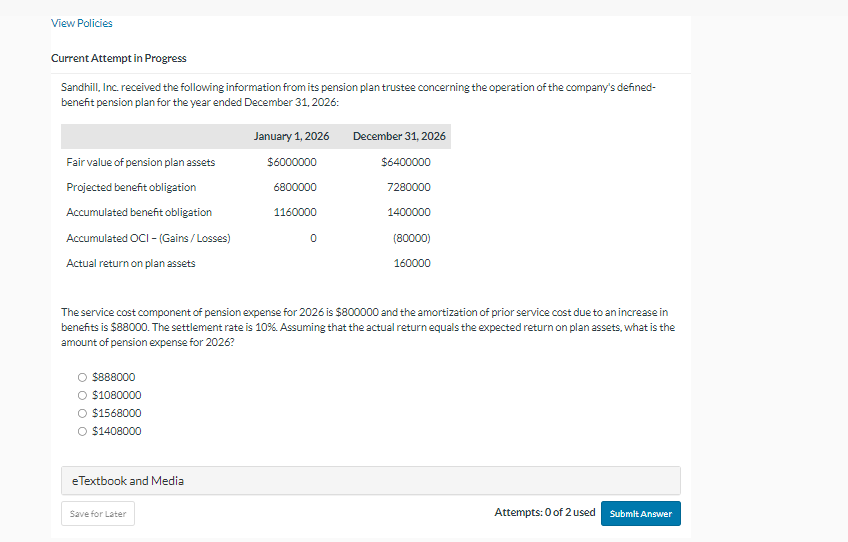

Question: Current Attempt in Progress Sandhill, Inc. received the following information from its pension plan trustee concerning the operation of the company's definedbenefit pension plan for

Current Attempt in Progress Sandhill, Inc. received the following information from its pension plan trustee concerning the operation of the company's definedbenefit pension plan for the year ended December 31, 2026: The service cost component of pension expense for 2026 is $800000 and the amortization of prior service cost due to an increase in benefits is $88000. The settlement rate is 10%. Assuming that the actual return equals the expected return on plan assets, what is the amount of pension expense for 2026 ? $888000$1080000$1568000$1408000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock