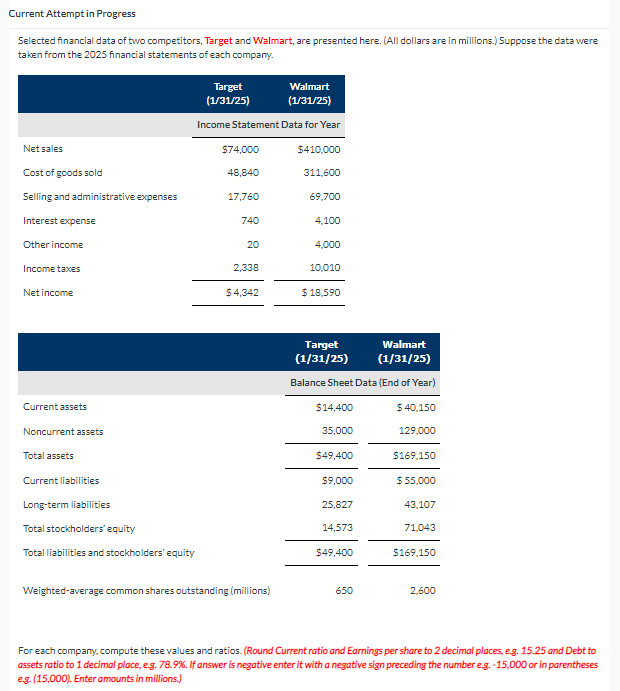

Question: Current Attempt in Progress Selected financial data of two competitors, Target and Walmart, are presented here. (All dollars are in millions.) Suppose the data were

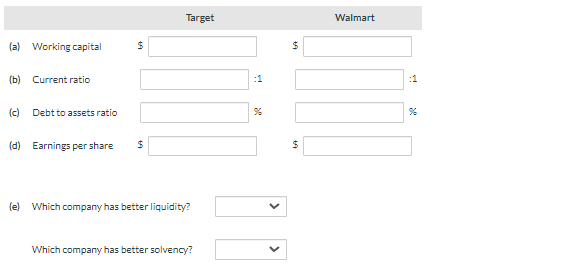

Current Attempt in Progress Selected financial data of two competitors, Target and Walmart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2025 financial statements of each company. For each company, compute these values and ratios. (Round Current ratio and Earnings per share to 2 decimal places, e.g. 15.25 and Debt to assets ratio to 1 decimal place, e.g. 78.9\%. If answer is negative enter it with a negative sign preceding the number e.g. - 15,000 or in parentheses e.g. (15,000). Enter amounts in millions.) (b) Current ratio :1 :1 (c) Debt to assets ratio % % (d) Earnings per share 5 (e) Which company has better liquidity? Which company has better solvency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts