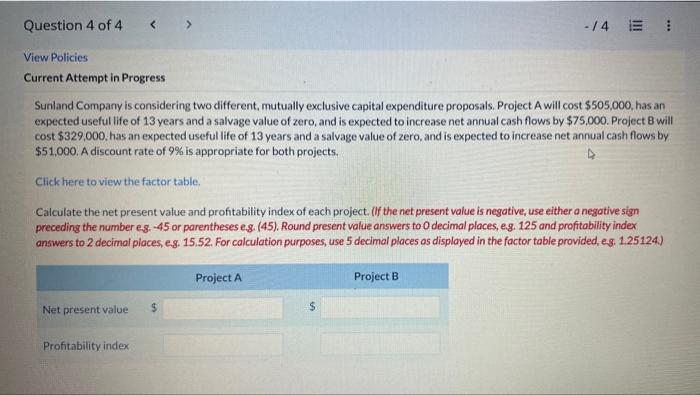

Question: Current Attempt in Progress Sunland Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $505,000, has an expected useful life

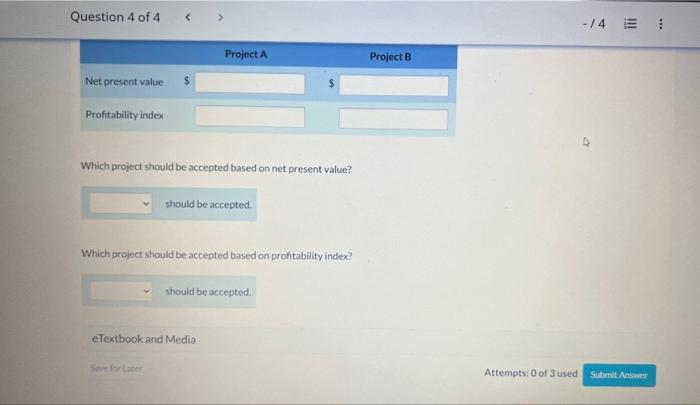

Current Attempt in Progress Sunland Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $505,000, has an expected useful life of 13 years and a salvage value of zero, and is expected to increase net annual cash flows by $75,000. Project 8 will cost \$329,000, has an expected useful life of 13 years and a salvage value of zero, and is expected to increase net annual cash flows by $51,000. A discount rate of 9% is appropriate for both projects. Click here to view the factor table. Calculate the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number e.8. 45 or parentheses e. . (45). Round present value answers to O decimal places, e.g. 125 and profitability index answers to 2 decimal ploces, eg. 15.52. For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124. Which project should be accepted based on net present value? Which project should be accepted based on profitability index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts