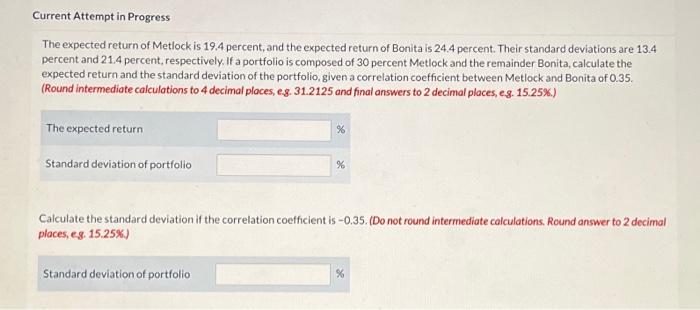

Question: Current Attempt in Progress The expected return of Metlock is 19.4 percent, and the expected return of Bonita is 24.4 percent. Their standard deviations are

The expected return of Metlock is 19.4 percent, and the expected return of Bonita is 24.4 percent. Their standard deviations are 13.4 percent and 21.4 percent, respectively. If a portfolio is composed of 30 percent Metlock and the remainder Bonita, calculate the expected return and the standard deviation of the portfolio, given a correlation coefficient between Metlock and Bonita of 0.35 . (Round intermediate calculations to 4 decimal places, eg. 31.2125 and final answers to 2 decimal places, e. g. 15.25\%.) Calculate the standard deviation if the correlation coefficient is -0.35 . (Do not round intermediate calculations. Round answer to 2 decimal places, es. 15.25\%.) Standard deviation of portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts