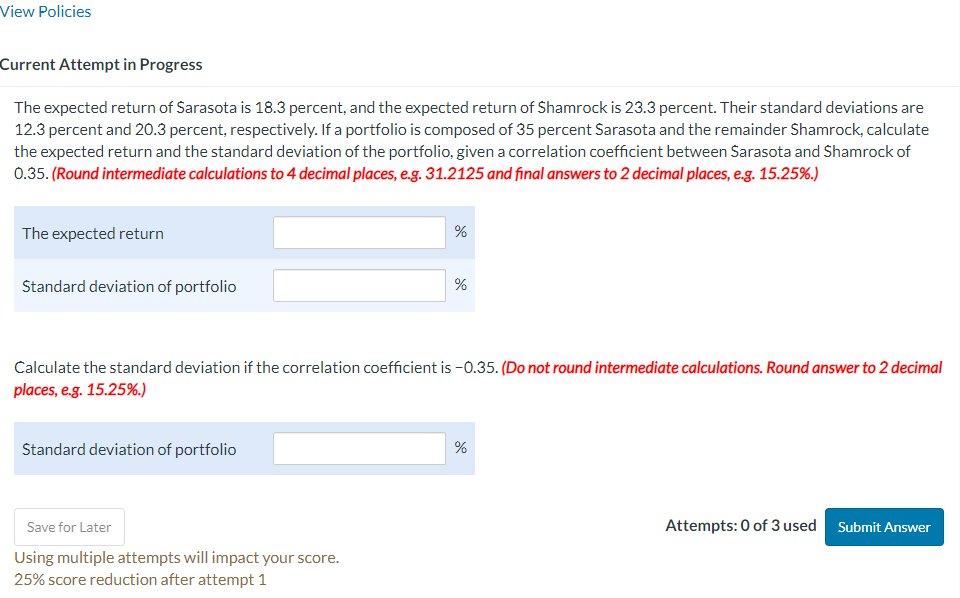

Question: Current Attempt in Progress The expected return of Sarasota is 1 8 . 3 percent, and the expected return of Shamrock is 2 3 .

Current Attempt in Progress

The expected return of Sarasota is percent, and the expected return of Shamrock is percent. Their standard deviations are

percent and percent, respectively. If a portfolio is composed of percent Sarasota and the remainder Shamrock, calculate

the expected return and the standard deviation of the portfolio, given a correlation coefficient between Sarasota and Shamrock of

Round intermediate calculations to decimal places, eg and final answers to decimal places, eg

The expected return

Standard deviation of portfolio

Calculate the standard deviation if the correlation coefficient is Do not round intermediate calculations. Round answer to decimal

places, eg

Standard deviation of portfolio

Attempts: of used

Using multiple attempts will impact your score.

score reduction after attempt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock