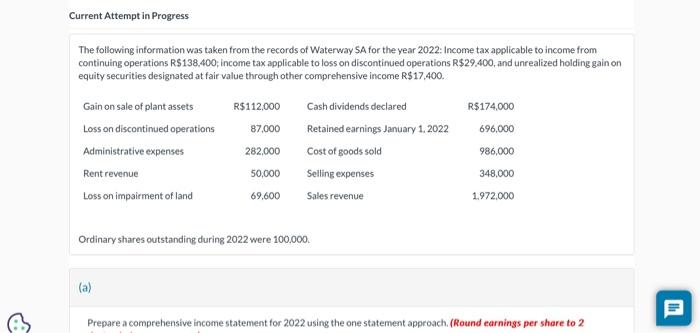

Question: Current Attempt in Progress The following information was taken from the records of Waterway SA for the year 2022: Income tax applicable to income from

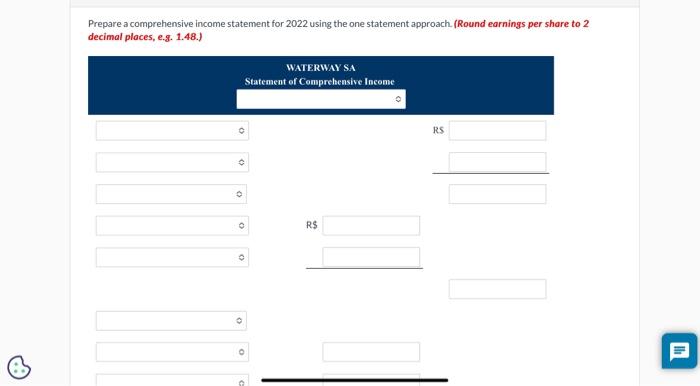

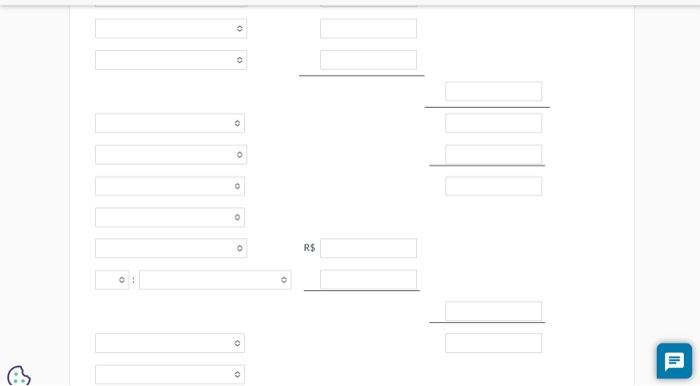

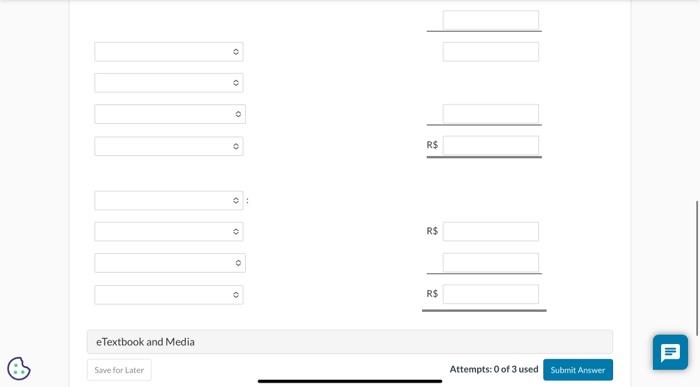

Current Attempt in Progress The following information was taken from the records of Waterway SA for the year 2022: Income tax applicable to income from continuing operations R$138,400; income tax applicable to loss on discontinued operations R$29,400, and unrealized holding gain on equity securities designated at fair value through other comprehensive income R$17,400. Ordinary shares outstanding during 2022 were 100,000 . (a) Prepare a comprehensive income statement for 2022 using the one statement approach. (Round earnings per share to 2 Prepare a comprehensive income statement for 2022 using the one statement approach (Round earnings per share to 2 decimal places, e.g. 1.48.) eTextbook and Media Swe for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts