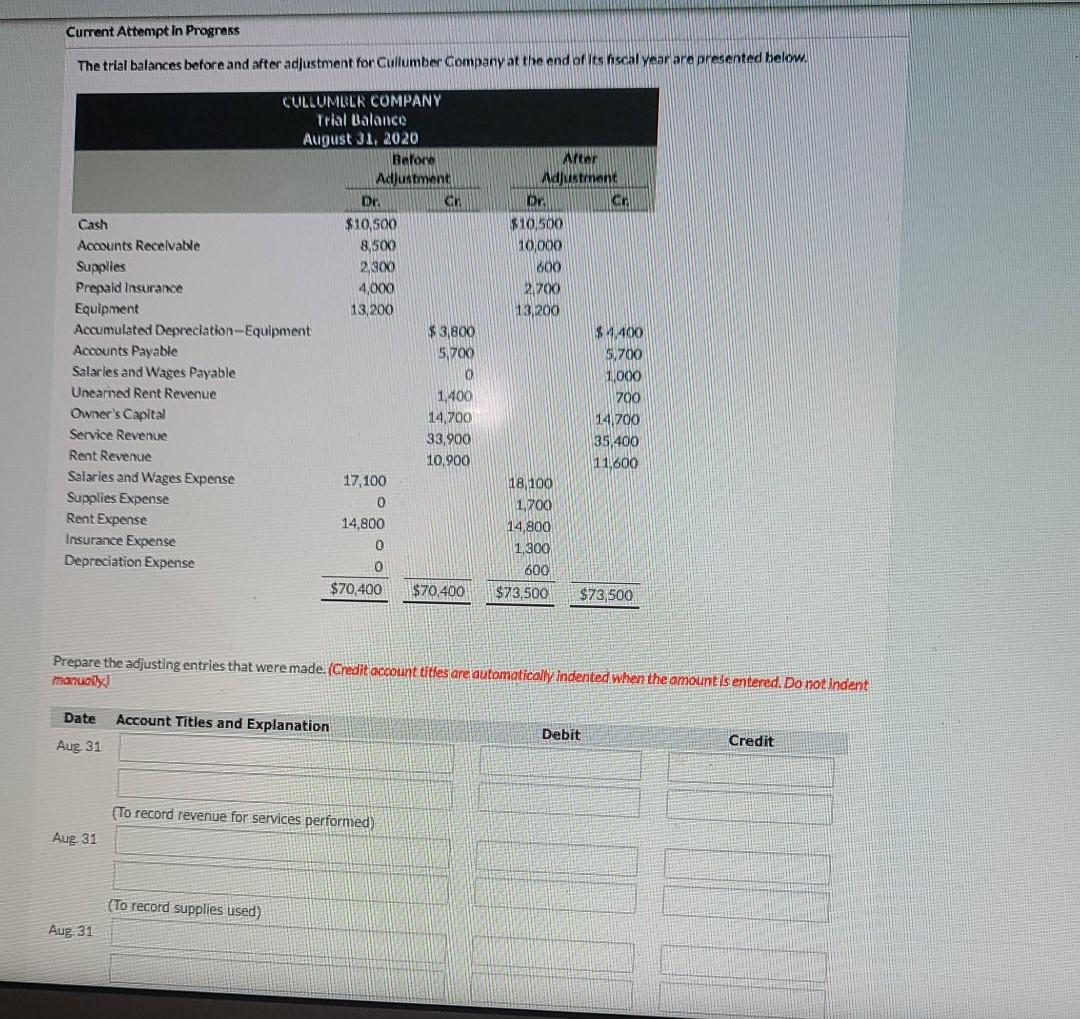

Question: Current Attempt In Progress The trial balances before and after adjustment for Cullumber Company at the end of its hiscal year are presented below. CULLUMBLR

Current Attempt In Progress The trial balances before and after adjustment for Cullumber Company at the end of its hiscal year are presented below. CULLUMBLR COMPANY Trial balance August 31, 2020 Before Adjustment Dr an Cash $10,500 Accounts Recevable 8,500 Supplies 2,800 Prepaid Insurance 4,000 Equipment 13,200 Accumulated Depreciation Equipment $3,800 Accounts Payable 5,700 Salaries and Wages Payable 0 Unearned Rent Revenue 1,400 Owner's Capital 14,700 Service Revenue 33,900 Rent Revenue 10,900 Salaries and Wages Expense 17,100 Supplies Expense 0 Rent Expense 14,800 Insurance Expense 0 Depreciation Expense 0 $70,400 $70,400 Arter Adjust Dr CA X10,500 10,000 600 2,700 113,200 $2.400 5,700 1.000 700 14700 35.400 11,600 18,100 1,700 14,800 1,300 600 $73,500 $73,500 Prepare the adjusting entries that were made. (Credit account titles are automatically indented when the amount is entered. Do notindent manually Date Account Titles and Explanation Debit Aug. 31 Credit (To record revenue for services performed) Aug. 31 (To record supplies used) Aug. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts