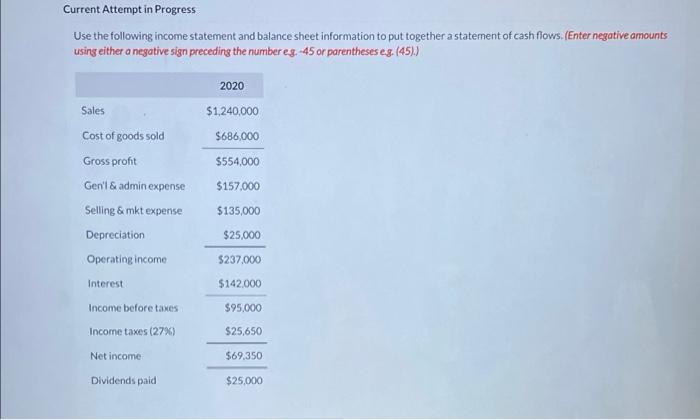

Question: Current Attempt in Progress Use the following income statement and balance sheet information to put together a statement of cash flows.(Enter negative amounts using either

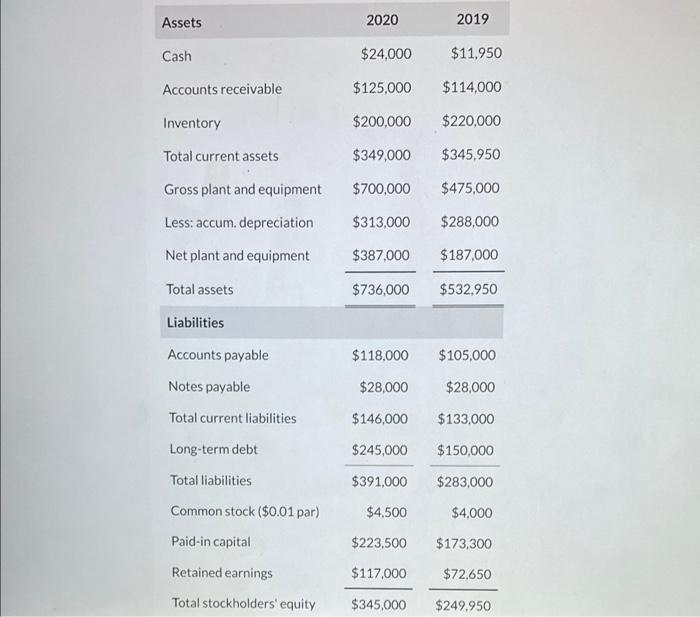

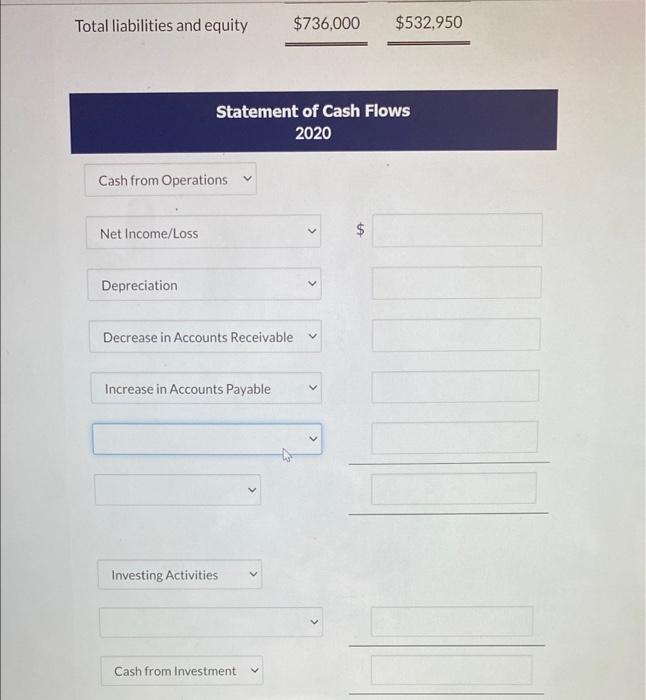

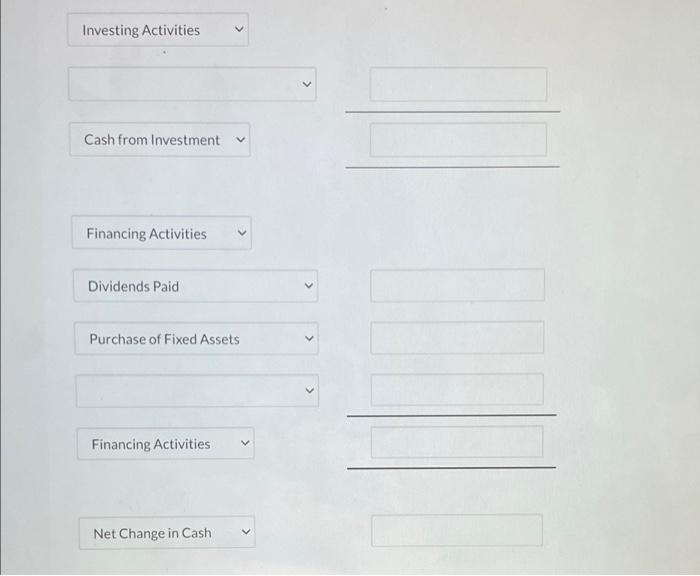

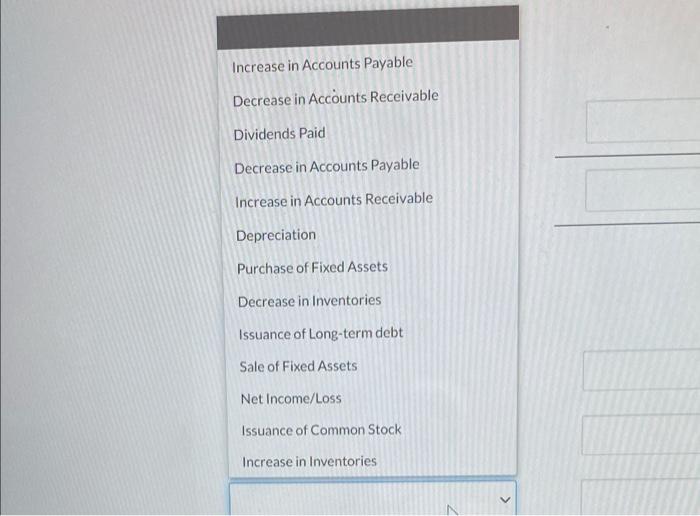

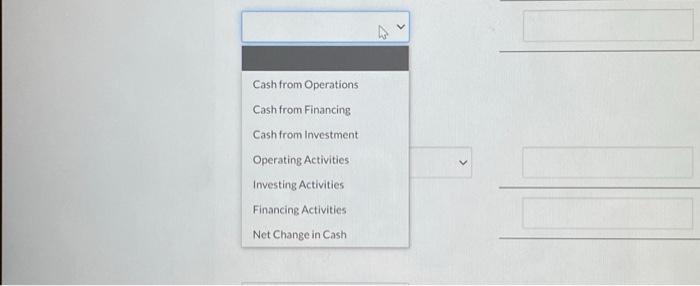

Current Attempt in Progress Use the following income statement and balance sheet information to put together a statement of cash flows.(Enter negative amounts using either a negative sigri preceding the number eg. 45 or parentheses eg. (45) Sales 2020 $1,240,000 $686,000 $554,000 Cost of goods sold Gross profit Gen'l & admin expense Selling & mkt expense Depreciation Operating income Interest Income before taxes $157.000 $135,000 $25,000 $237.000 $142.000 $95.000 Income taxes (27%) $25,650 Net income $69,350 Dividends paid $25,000 Assets 2020 2019 Cash $24,000 $11.950 Accounts receivable $125,000 $114,000 Inventory $200,000 $220,000 Total current assets $349,000 $345.950 Gross plant and equipment $700,000 $475,000 Less: accum. depreciation $313,000 $288,000 Net plant and equipment $387,000 $187.000 $736,000 $532,950 Total assets Liabilities Accounts payable $118.000 $105,000 Notes payable $28,000 $28,000 Total current liabilities $146,000 $133.000 Long-term debt $245,000 $150,000 Total liabilities $391,000 $283,000 Common stock ($0.01 par) $4,500 $4,000 Paid-in capital $223.500 $173,300 Retained earnings $117,000 $72.650 Total stockholders' equity $345,000 $249.950 Total liabilities and equity $736,000 $532,950 Statement of Cash Flows 2020 Cash from Operations Net Income/Loss $ Depreciation v Decrease in Accounts Receivable Increase in Accounts Payable Investing Activities Cash from Investment Investing Activities Cash from Investment Financing Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts