Question: Current Attempt in Progress X Your answer is incorrect. Anthony lives in Tacoma and frequently travels to Los Angeles for business. He incurs the following

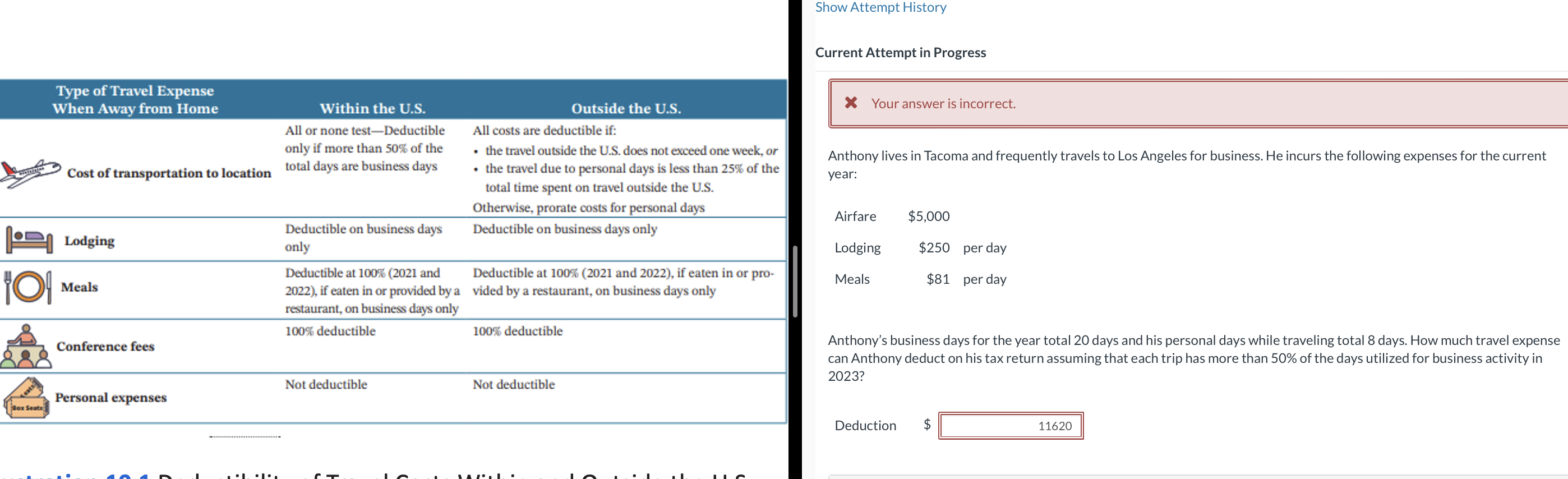

Current Attempt in Progress X Your answer is incorrect. Anthony lives in Tacoma and frequently travels to Los Angeles for business. He incurs the following expenses for the current year: Anthony's business days for the year total 20 days and his personal days while traveling total 8 days. How much travel expense can Anthony deduct on his tax return assuming that each trip has more than 50% of the days utilized for business activity in 2023? Deduction $ Current Attempt in Progress X Your answer is incorrect. Anthony lives in Tacoma and frequently travels to Los Angeles for business. He incurs the following expenses for the current year: Anthony's business days for the year total 20 days and his personal days while traveling total 8 days. How much travel expense can Anthony deduct on his tax return assuming that each trip has more than 50% of the days utilized for business activity in 2023? Deduction $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts