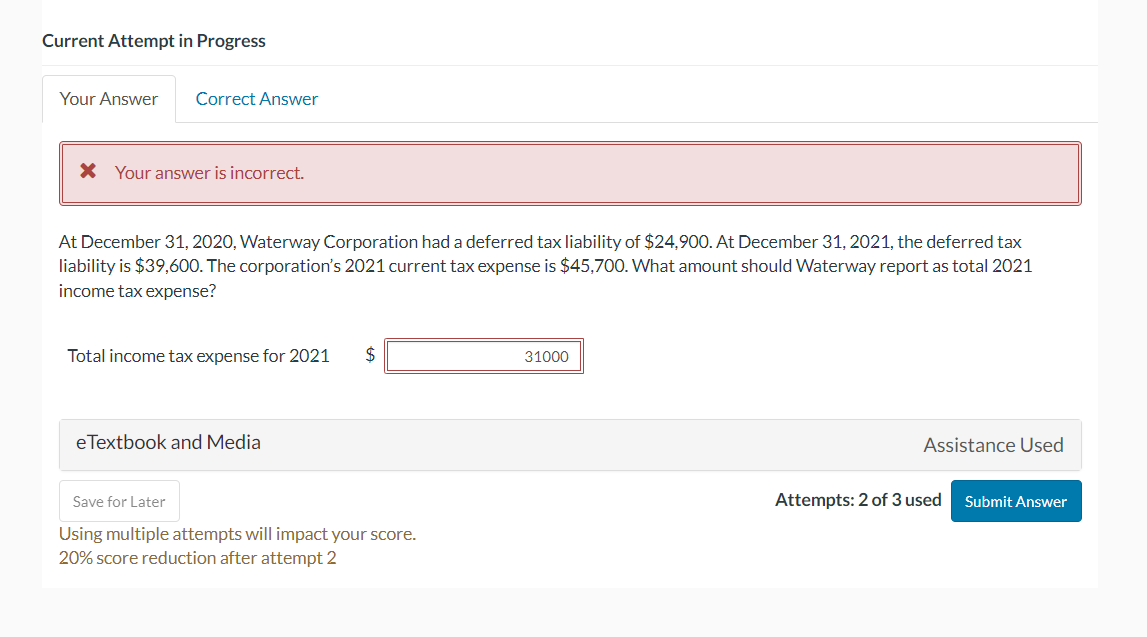

Question: Current Attempt in Progress X Your answer is incorrect. At December 31, 2020, Waterway Corporation had a deferred tax liability of $24,900. At December 31,2021

Current Attempt in Progress X Your answer is incorrect. At December 31, 2020, Waterway Corporation had a deferred tax liability of $24,900. At December 31,2021 , the deferred tax liability is $39,600. The corporation's 2021 current tax expense is $45,700. What amount should Waterway report as total 2021 income tax expense? Total income tax expense for 2021$ eTextbook and Media Assistance Used Attempts: 2 of 3 used Using multiple attempts will impact your score. 20% score reduction after attempt 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts