Question: Current Attempt in Progress Your answer is incorrect. An investment opportunity requires a payment of $630 for 12 years, starting a year from today. If

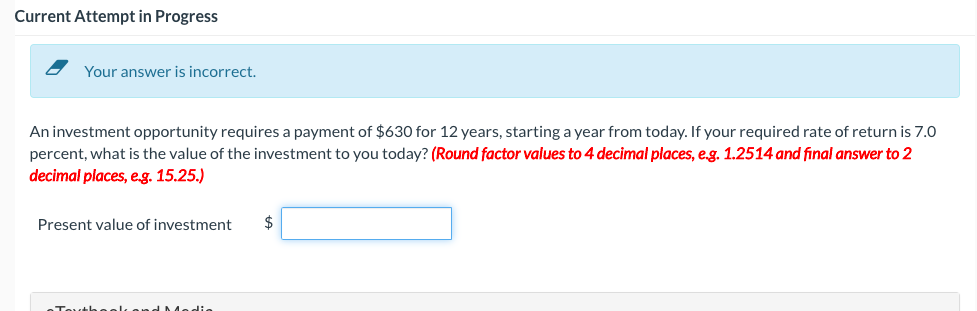

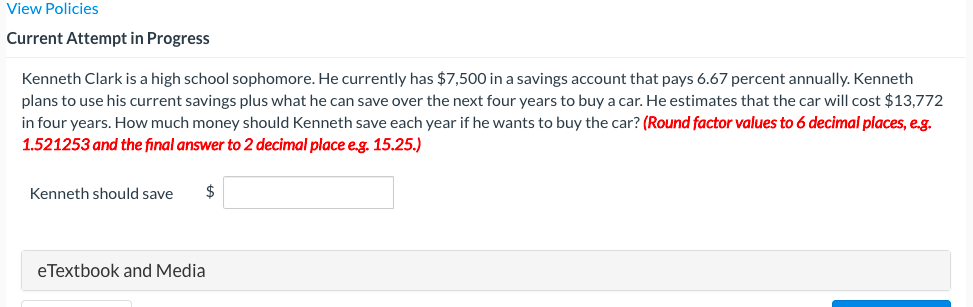

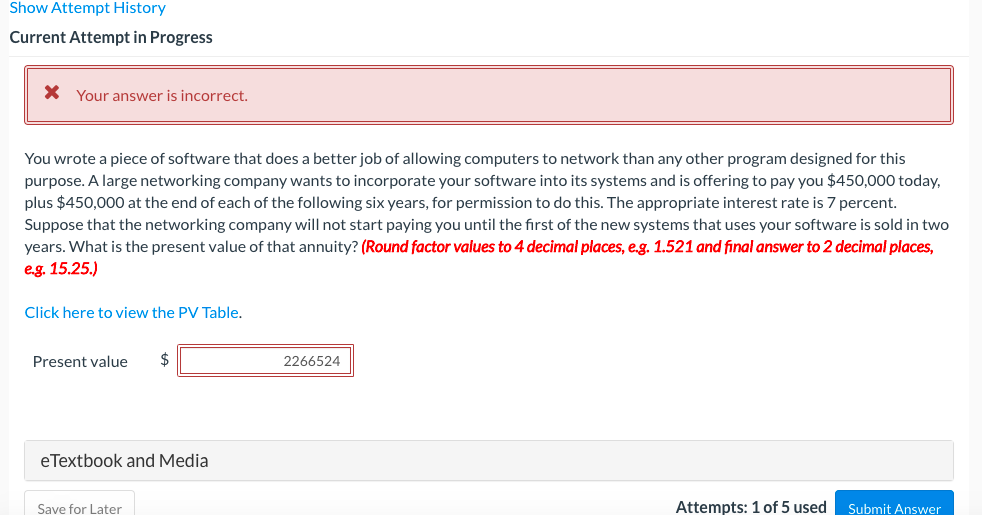

Current Attempt in Progress Your answer is incorrect. An investment opportunity requires a payment of $630 for 12 years, starting a year from today. If your required rate of return is 7.0 percent, what is the value of the investment to you today? (Round factor values to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, eg. 15.25.) Present value of investment $ and Media View Policies Current Attempt in Progress Kenneth Clark is a high school sophomore. He currently has $7,500 in a savings account that pays 6.67 percent annually. Kenneth plans to use his current savings plus what he can save over the next four years to buy a car. He estimates that the car will cost $13,772 in four years. How much money should Kenneth save each year if he wants to buy the car? (Round factor values to 6 decimal places, eg. 1.521253 and the final answer to 2 decimal place e.g. 15.25.) Kenneth should save $ e Textbook and Media Show Attempt History Current Attempt in Progress * Your answer is incorrect. You wrote a piece of software that does a better job of allowing computers to network than any other program designed for this purpose. A large networking company wants to incorporate your software into its systems and is offering to pay you $450,000 today, plus $450,000 at the end of each of the following six years, for permission to do this. The appropriate interest rate is 7 percent. Suppose that the networking company will not start paying you until the first of the new systems that uses your software is sold in two years. What is the present value of that annuity? (Round factor values to 4 decimal places, e.g. 1.521 and final answer to 2 decimal places, eg. 15.25.) Click here to view the PV Table. Present value $ 2266524 e Textbook and Media Save for Later Attempts: 1 of 5 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts