Question: Current Attempt in Progress Your answer is partially correct. Presented below are selected transactions on the books of Bridgeport Corporation. May 1 , 2 0

Current Attempt in Progress

Your answer is partially correct.

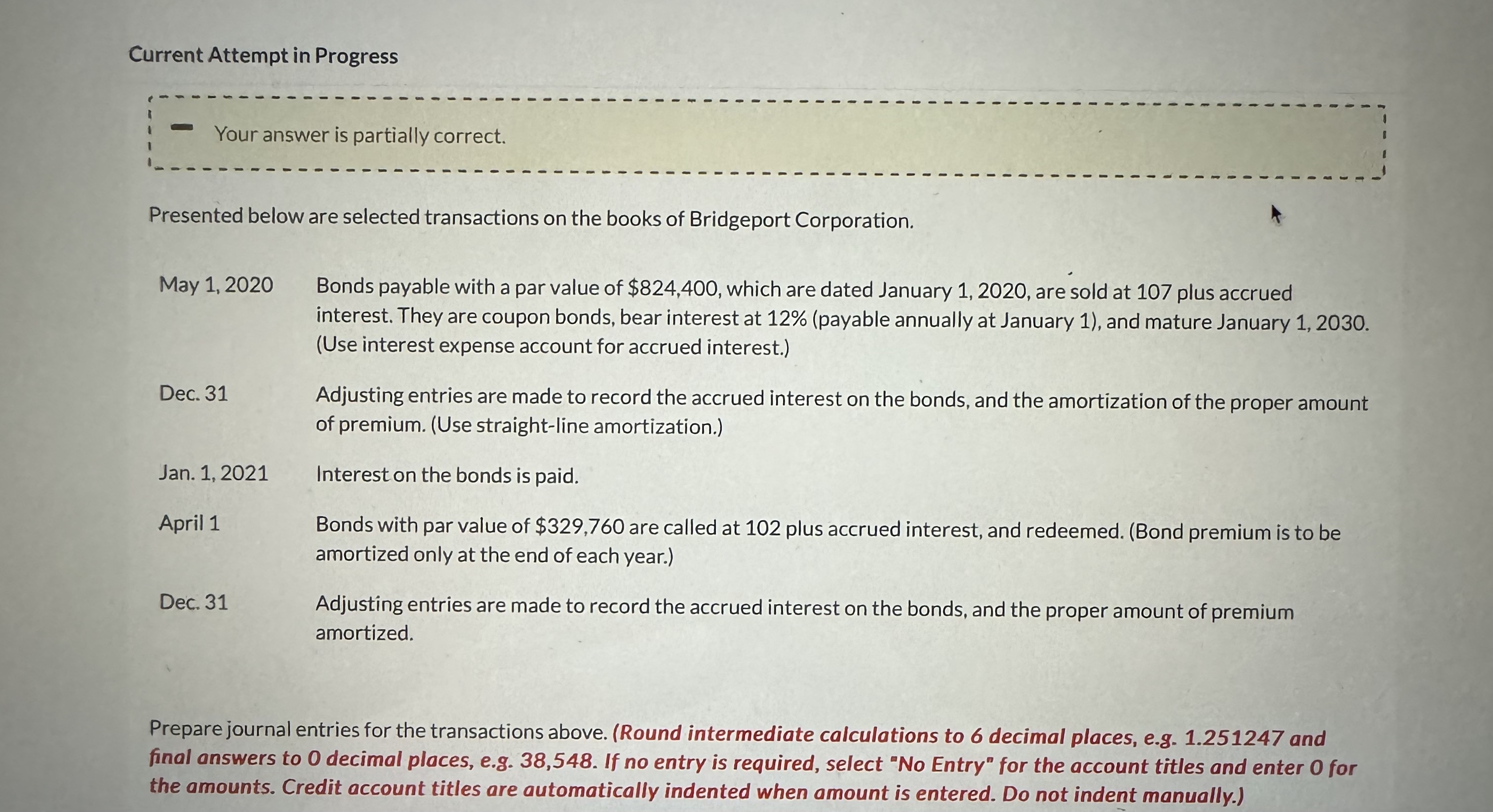

Presented below are selected transactions on the books of Bridgeport Corporation.

May Bonds payable with a par value of $ which are dated January are sold at plus accrued interest. They are coupon bonds, bear interest at payable annually at January and mature January Use interest expense account for accrued interest.

Dec. Adjusting entries are made to record the accrued interest on the bonds, and the amortization of the proper amount of premium. Use straightline amortization.

Jan. Interest on the bonds is paid.

April Bonds with par value of $ are called at plus accrued interest, and redeemed. Bond premium is to be amortized only at the end of each year.

Dec.

Adjusting entries are made to record the accrued interest on the bonds, and the proper amount of premium amortized.

Prepare journal entries for the transactions above. Round intermediate calculations to decimal places, eg and final answers to decimal places, eg If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock