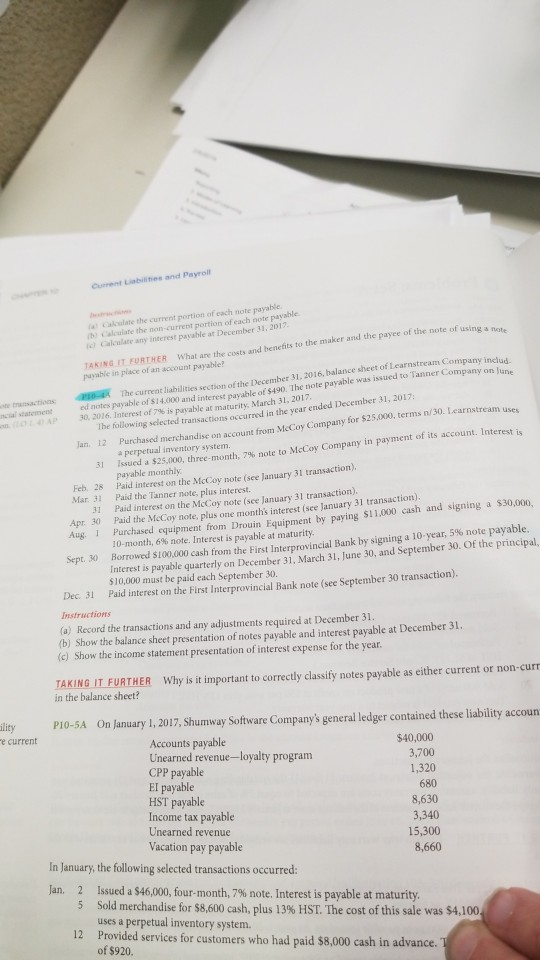

Question: Current Liabilities and Payroll . ( akulate the current portion of each note payable . ) Calculate the non-current portion of each note payable TAKING

Current Liabilities and Payroll . ( akulate the current portion of each note payable . ) Calculate the non-current portion of each note payable TAKING IT FURTHER What are the costs and benetits to the maker and the payee of the note of using a eu. payable in place of an account payable? c) Calculate any interest payable at December 31, 2017 te cransactionsk The current liabilities section of the December 31, 2016, balance sheet of Learnstream Company includ ncial statement ed notes payable of $1-4.000 and interest payable of $490. The note payable was issue on,;014, AP 30,2016. Interest of 7% is payable at maturity, March 31, 2017 lThe following selected transactions occurred in the year ended I Jan 12 Purchased merchandise on account from McCoy Company for $25,000, terms n/30. Learnstream use issued a $25,000, three-month, 7% note to McCoy Company in payable monthly a perpetual inventory system. ayment of its account. Interest s 31 Feb. 28 Paid interest on the McCoy no Mar. 31 Paid the Tanner note, plus interest. te (see January 31 transaction). Paid interest on the McCoy note (see January 31 transaction) Apr 30 Paid the MeCoy note, plus one month's interest (see January 31 transaction) Aug. 1 31 Purchased equipment from Drouin Equipment by paying $11,000 cash and signing a $30,000, 10-month, 6% note. Interest is payable at maturity. Borrowed $100,000 cash f Interest is payable quarterly on $10,000 must be paid each September 30 Paid interest on the First Interprovincial Bank note (see September 30 transaction) Sept. 30 o n the First Interprovincial Bank by signing a 10-year,5% note payable. December 31, March 31, June 30, and September 30. Of the principal, Dec. 31 (a) Record the transactions and any adjustments required at December 31 (b) Show the balance sheet presentation of notes payable and interest payable at December 31 (c) Show the income statement presentation of interest expense for the year. TAKING IT FURTHER in the balance sheet? Why is it important to correctly classify notes payable as either current or non-curr P10-5A On January 1, 2017, Shumway Software Company' general ledger contained these liability accoun e current Accounts payable Unearned revenue-loyalty program CPP payable El payable HST payable Income tax payable Unearned revenue Vacation pay payable $40,000 3,700 1,320 680 8,630 3,340 15,300 8,660 In January, the following selected transactions occurred: Jan. 2 Issued a$46,000, four-month, 7% note. Interest is payable at maturity 5 Sold merchandise for S8.600 cash, plus 13% HST. The cost of this sale was $4,100 uses a perpetual inventory system. 12 Provided services for customers who had paid $8,000 cash in advance of $920

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts