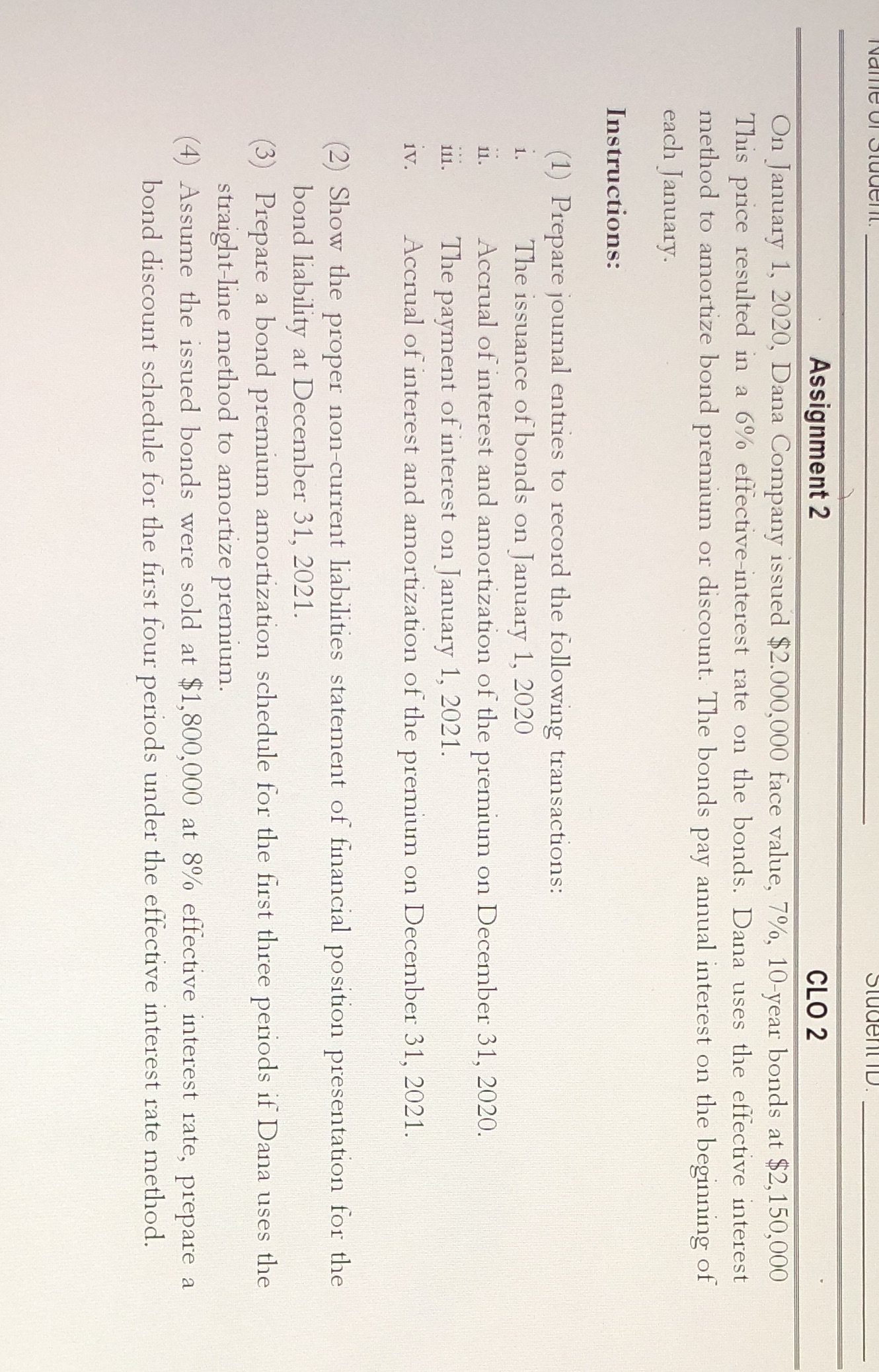

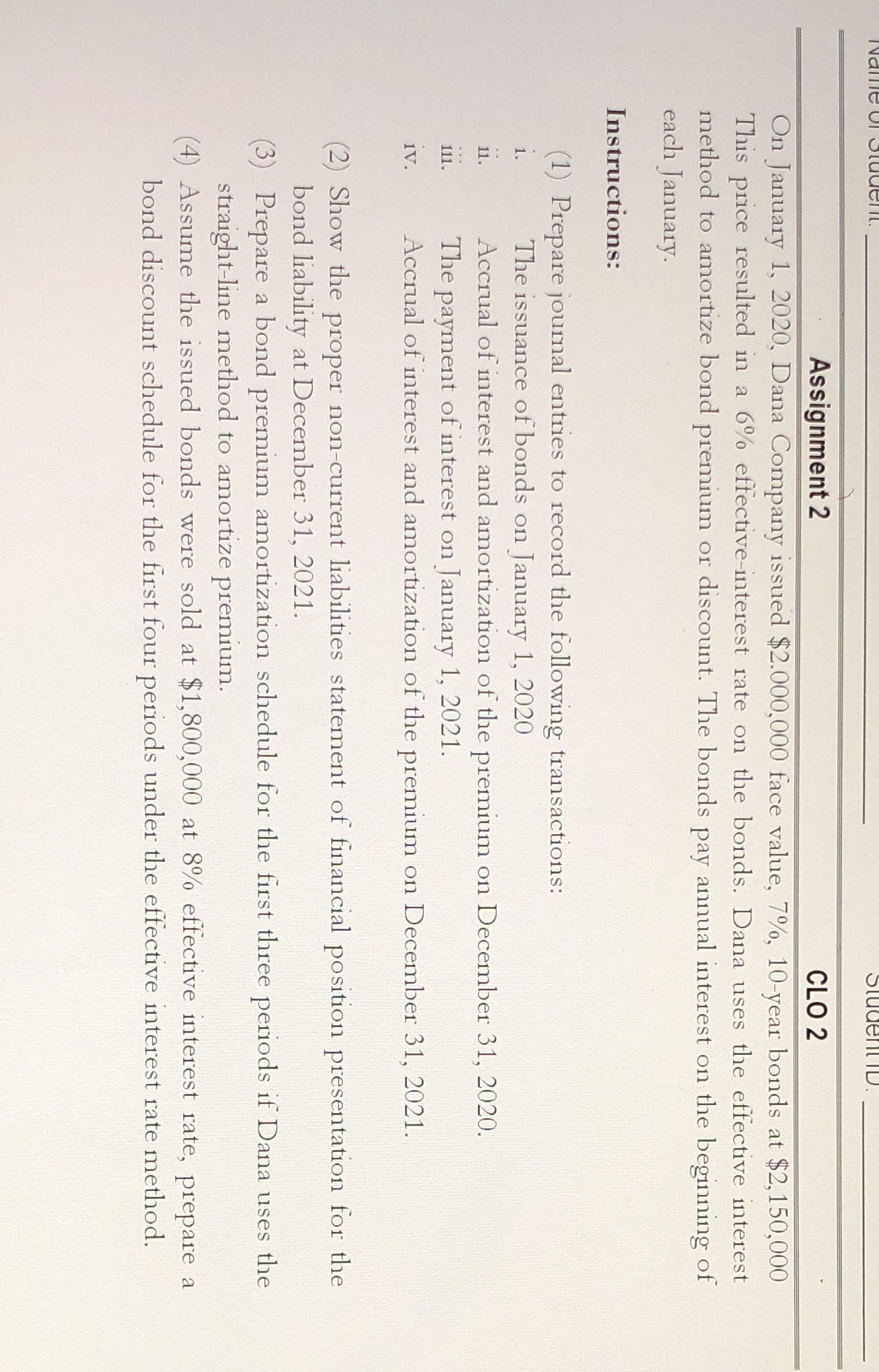

Question: Current liabilities Assignment 2 CLO 2 On January 1, 2020, Dana Company issued $2.000,000 face value, 7%, 10-year bonds at $2, 150,000 This price resulted

Current liabilities

Assignment 2 CLO 2 On January 1, 2020, Dana Company issued $2.000,000 face value, 7%, 10-year bonds at $2, 150,000 This price resulted in a 6% effective-interest rate on the bonds. Dana uses the effective interest method to amortize bond premium or discount. The bonds pay annual interest on the beginning of each January. Instructions: (1) Prepare journal entries to record the following transactions: The issuance of bonds on January 1, 2020 Accrual of interest and amortization of the premium on December 31, 2020. . . . 111. The payment of interest on January 1, 2021. IV . Accrual of interest and amortization of the premium on December 31, 2021. (2) Show the proper non-current liabilities statement of financial position presentation for the bond liability at December 31, 2021. (3) Prepare a bond premium amortization schedule for the first three periods if Dana uses the straight-line method to amortize premium. (4) Assume the issued bonds were sold at $1,800,000 at 8% effective interest rate, prepare a bond discount schedule for the first four periods under the effective interest rate method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts