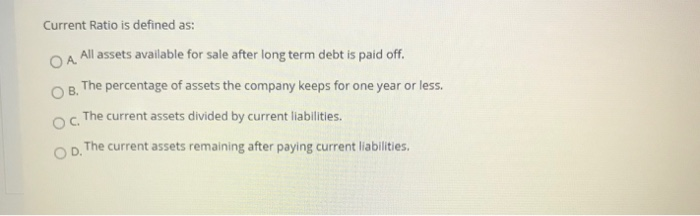

Question: Current Ratio is defined as: O A. All assets available for sale after long term debt is paid off. OB. The percentage of assets the

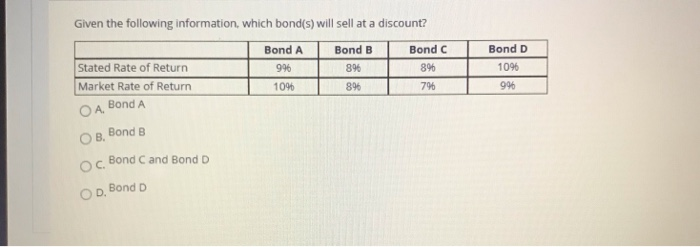

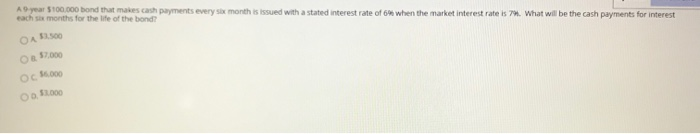

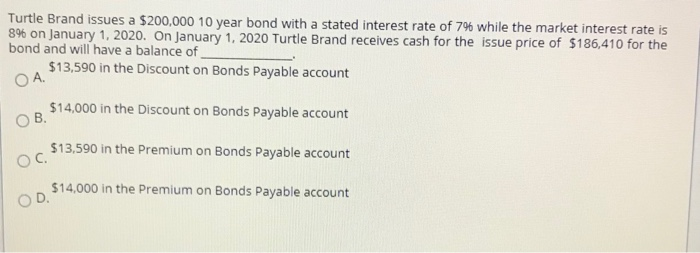

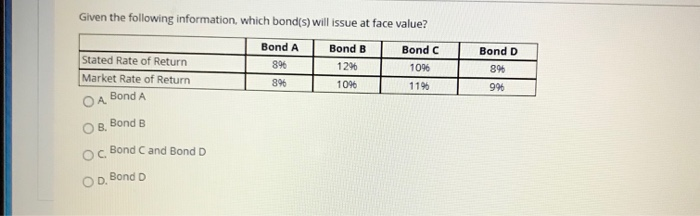

Current Ratio is defined as: O A. All assets available for sale after long term debt is paid off. OB. The percentage of assets the company keeps for one year or less. The current assets divided by current liabilities. Od. The current assets remaining after paying current liabilities, . Given the following information, which bond(s) will sell at a discount? Bond A 996 Bond B 896 Bond c 896 Stated Rate of Return Market Rate of Return Bond A Bond D 1096 996 10% 896 796 . Bond B . oc Bond C and Bond D Bond D OD A 9 year $100.000 bond that makes cash payments every six month is issued with a stated interest rate of 6 when the market interest rate is 74. What will be the cash payments for interest each six months for the life of the bond? O A13300 O 5.000 Oc 55.000 OD 1.000 Turtle Brand issues a $200,000 10 year bond with a stated interest rate of 79 while the market interest rate is 8% on January 1, 2020. On January 1, 2020 Turtle Brand receives cash for the issue price of $186,410 for the bond and will have a balance of $13,590 in the Discount on Bonds Payable account OA $14,000 in the Discount on Bonds Payable account B. $13,590 in the Premium on Bonds Payable account . $14,000 in the Premium on Bonds Payable account D. Given the following information, which bond(s) will issue at face value? Bond A 896 896 Bond B 12% 1096 Bond C 1096 Bond D 896 11% Stated Rate of Return Market Rate of Return Bond A Bond B 996 . . Bond C and Bond D D. Bond D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts