Question: Current ratio Quick ratio Inventory turnover Average collection period Average payment period Total asset turnover Debt ratio Times interest earned ratio Fixed-payment coverage ratio Gross

- Current ratio

- Quick ratio

- Inventory turnover

- Average collection period

- Average payment period

- Total asset turnover

- Debt ratio

- Times interest earned ratio

- Fixed-payment coverage ratio

- Gross profit margin

- Operating profit margin

- Net profit margin

- Return on total assets (ROA)

- Return on common equity (ROE)

- Earnings per share (EPS)

- Price/earnings (P/E) ratio

- Market/book ratio (M/B) ratio

- DU pont

- Modified DU pont

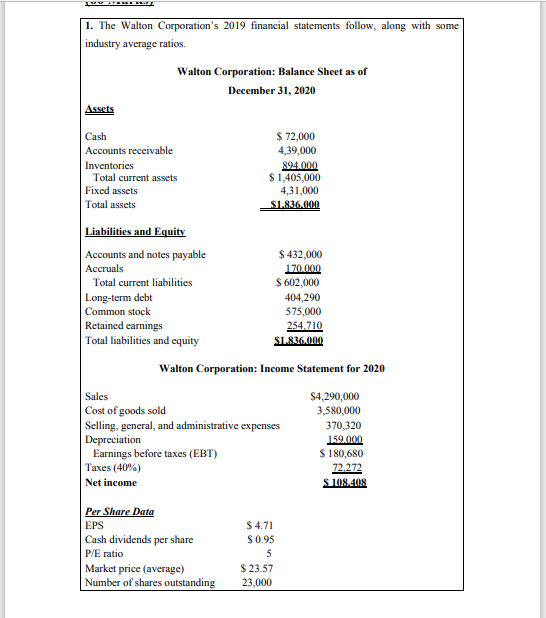

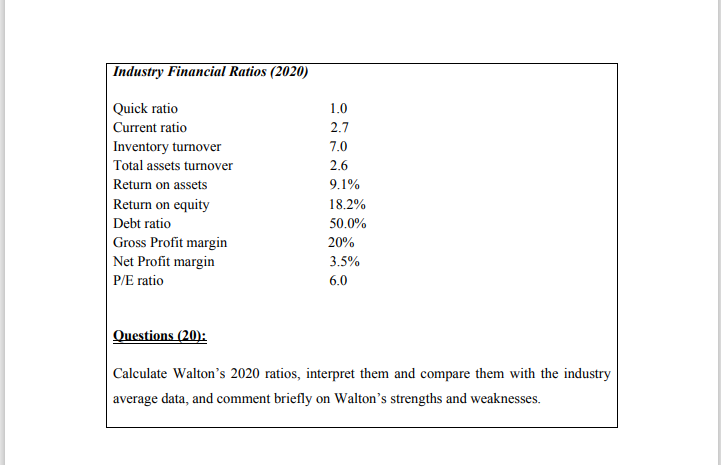

1. The Walton Corporation's 2019 financial statements follow, along with some industry average ratios. Walton Corporation: Balance Sheet as of December 31, 2020 Assets Cash Accounts receivable Inventories Total current assets Fixed assets Total assets $ 72,000 4,39,000 894.000 $ 1,405,000 4,31,000 SL836.000 Liabilities and Equity Accounts and notes payable $ 432,000 Accruals 170.000 Total current liabilities $ 602,000 Long-term debt 404,290 Common stock 575,000 Retained earnings 254.710 Total liabilities and equity S1.836.000 Walton Corporation: Income Statement for 2020 Sales Cost of goods sold Selling, general, and administrative expenses Depreciation Earnings before taxes (EBT) Taxes (40%) Net income $4,290,000 3,580,000 370,320 159.000 $ 180,680 72.272 S 108.408 Per Share Data EPS Cash dividends per share P/E ratio Market price (average) Number of shares outstanding $ 4.71 S 0.95 5 $23.57 23,000 Industry Financial Ratios (2020) 1.0 Quick ratio Current ratio Inventory turnover Total assets turnover Return on assets Return on equity Debt ratio Gross Profit margin Net Profit margin P/E ratio 2.7 7.0 2.6 9.1% 18.2% 50.0% 20% 3.5% 6.0 Questions (20): Calculate Walton's 2020 ratios, interpret them and compare them with the industry average data, and comment briefly on Walton's strengths and weaknesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts