Question: currently has no debt. How much would the ROE increase if the company took on 50% debt with an interest rate of 10% (i.e. the

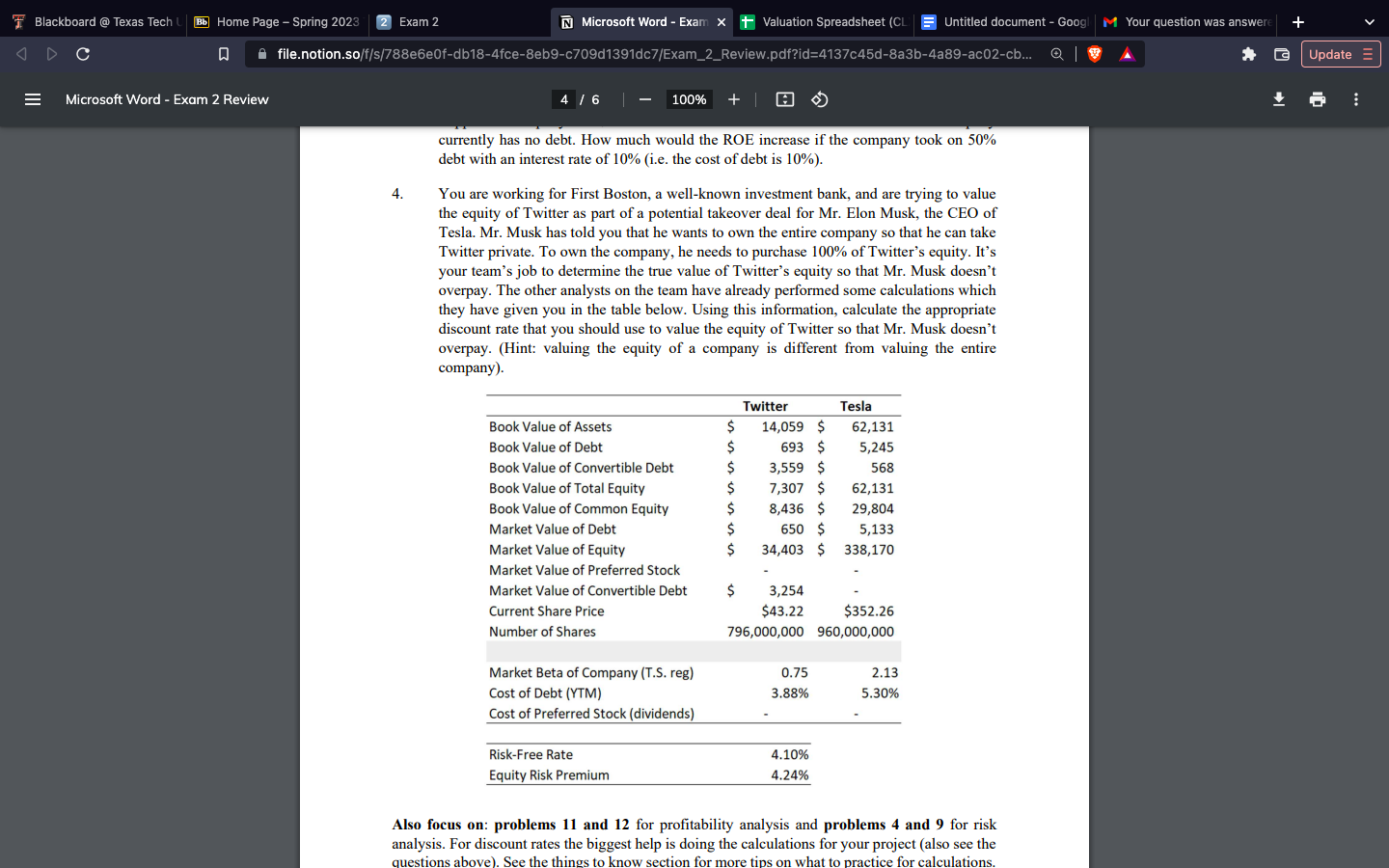

currently has no debt. How much would the ROE increase if the company took on 50% debt with an interest rate of 10% (i.e. the cost of debt is 10% ). 4. You are working for First Boston, a well-known investment bank, and are trying to value the equity of Twitter as part of a potential takeover deal for Mr. Elon Musk, the CEO of Tesla. Mr. Musk has told you that he wants to own the entire company so that he can take Twitter private. To own the company, he needs to purchase 100% of Twitter's equity. It's your team's job to determine the true value of Twitter's equity so that Mr. Musk doesn't overpay. The other analysts on the team have already performed some calculations which they have given you in the table below. Using this information, calculate the appropriate discount rate that you should use to value the equity of Twitter so that Mr. Musk doesn't overpay. (Hint: valuing the equity of a company is different from valuing the entire company). Also focus on: problems 11 and 12 for profitability analysis and problems 4 and 9 for risk analysis. For discount rates the biggest help is doing the calculations for your project (also see the questions above). See the things to know section for more tips on what to practice for calculations. currently has no debt. How much would the ROE increase if the company took on 50% debt with an interest rate of 10% (i.e. the cost of debt is 10% ). 4. You are working for First Boston, a well-known investment bank, and are trying to value the equity of Twitter as part of a potential takeover deal for Mr. Elon Musk, the CEO of Tesla. Mr. Musk has told you that he wants to own the entire company so that he can take Twitter private. To own the company, he needs to purchase 100% of Twitter's equity. It's your team's job to determine the true value of Twitter's equity so that Mr. Musk doesn't overpay. The other analysts on the team have already performed some calculations which they have given you in the table below. Using this information, calculate the appropriate discount rate that you should use to value the equity of Twitter so that Mr. Musk doesn't overpay. (Hint: valuing the equity of a company is different from valuing the entire company). Also focus on: problems 11 and 12 for profitability analysis and problems 4 and 9 for risk analysis. For discount rates the biggest help is doing the calculations for your project (also see the questions above). See the things to know section for more tips on what to practice for calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts