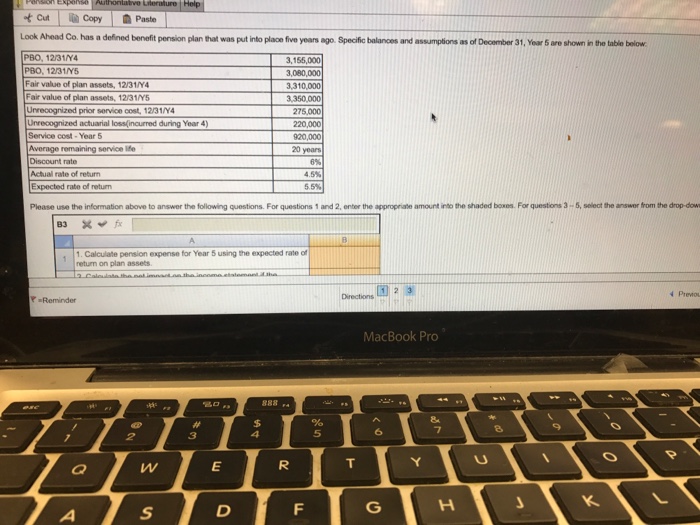

Question: Cut |Copy Paste Look Ahead Co. has a defined benefit pension plan that was put into place five years ago. Specific balances and assumptions as

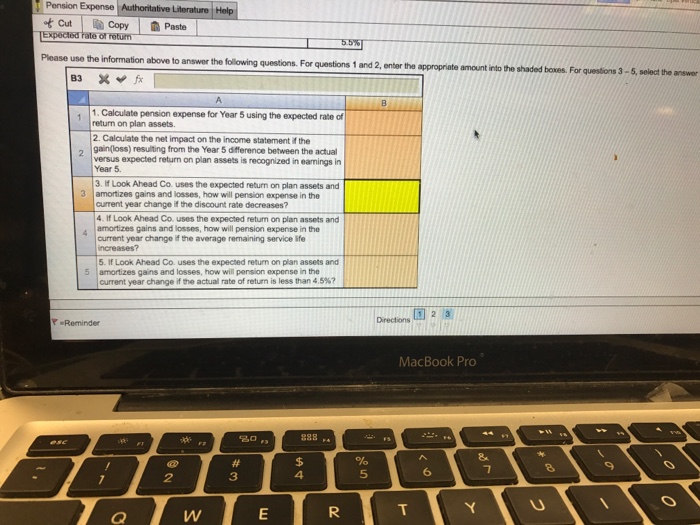

Cut |Copy Paste Look Ahead Co. has a defined benefit pension plan that was put into place five years ago. Specific balances and assumptions as of December 31, Year 5 are shown in the table below PBO, 12/31N4 P80, 1231s Fair value of plan assets, 12/31/Y4 Fair value of plan assets, 12/31M5 Unrecognized prior service cost, 12/31/N4 3,155,000 3,080 3,310,000 3,350,000 275,000 220,000 ized actuarial loss(incurred during Year 4) Service cost- Year 5 Average remaining service life Discount rate Actual rate of return Expected rate of returm 20 years 6% 45% 5% Please use the information above to answer the following questions. For questions 1 and 2, enter the appropriate amount into the shaded boxes. For questions 3- 8, select the answor from the drop-dow . Calculate pension expense for Year 5 using the expected rate of return on plan assets 2-3 4 Preno MacBook Pro 6 vw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts