Question: Cyclone Industrial is considering a project with an initial cost of $ 3 . 5 million to purchase a piece of equipment, which will be

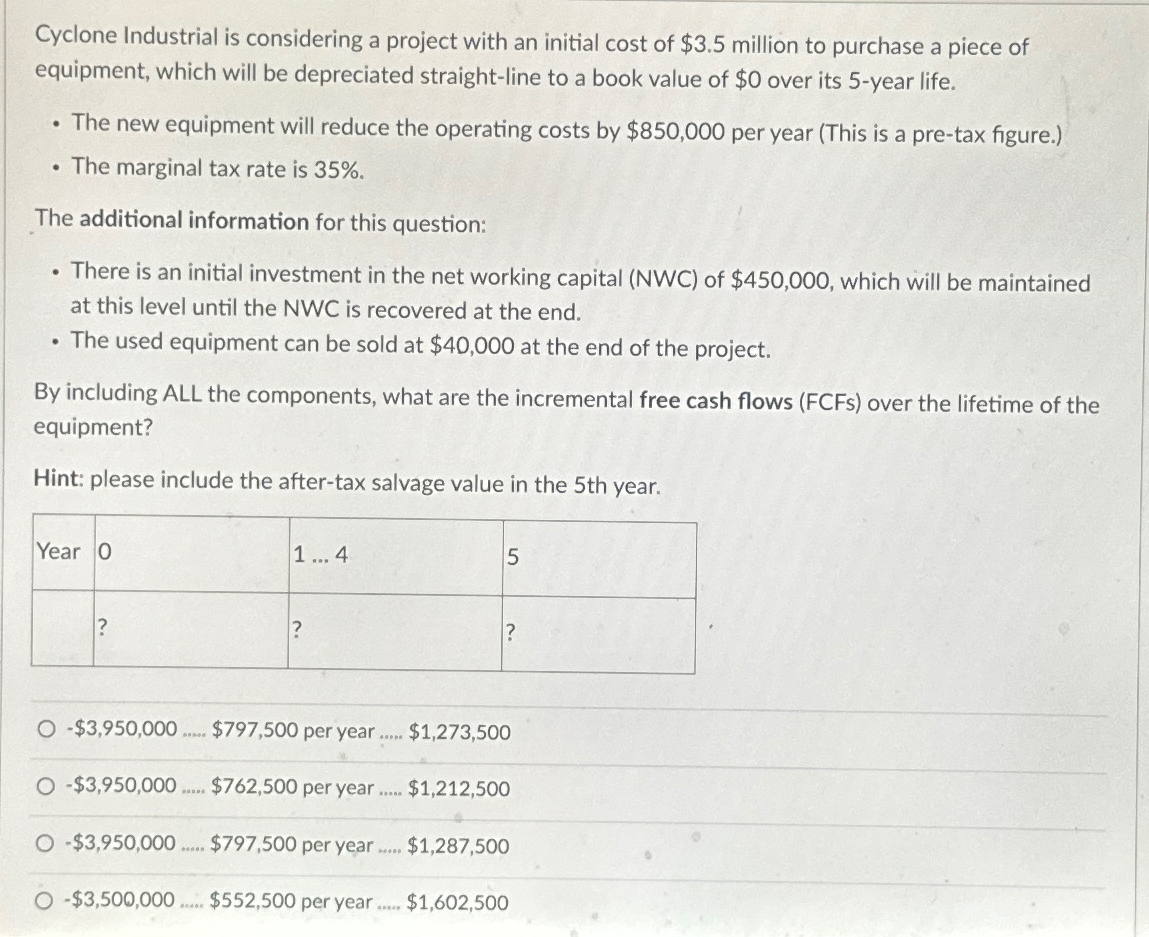

Cyclone Industrial is considering a project with an initial cost of $ million to purchase a piece of equipment, which will be depreciated straightline to a book value of $ over its year life.

The new equipment will reduce the operating costs by $ per year This is a pretax figure.

The marginal tax rate is

The additional information for this question:

There is an initial investment in the net working capital NWC of $ which will be maintained at this level until the NWC is recovered at the end.

The used equipment can be sold at $ at the end of the project.

By including ALL the components, what are the incremental free cash flows FCFs over the lifetime of the equipment?

Hint: please include the aftertax salvage value in the th year.

tableYeardots

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock