Question: Question #19 - #20 will use the following setup. Cyclone Industrial is considering a project with an initial cost of $2.5 million to purchase a

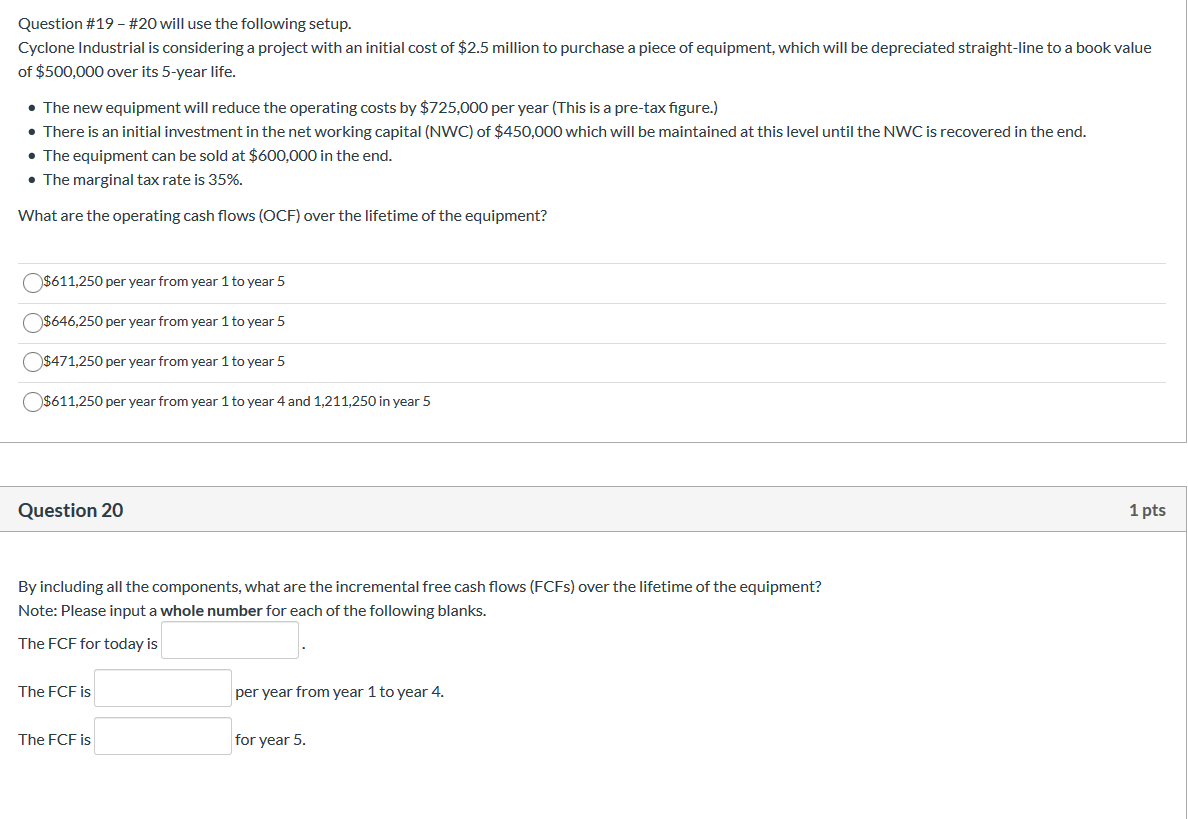

Question #19 - #20 will use the following setup. Cyclone Industrial is considering a project with an initial cost of $2.5 million to purchase a piece of equipment, which will be depreciated straight-line to a book value of $500,000 over its 5-year life. The new equipment will reduce the operating costs by $725,000 per year (This is a pre-tax figure.) There is an initial investment in the net working capital (NWC) of $450,000 which will be maintained at this level until the NWC is recovered in the end. The equipment can be sold at $600,000 in the end. The marginal tax rate is 35%. What are the operating cash flows (OCF) over the lifetime of the equipment? $611,250 per year from year 1 to year 5 $646,250 per year from year 1 to year 5 $471,250 per year from year 1 to year 5 $611,250 per year from year 1 to year 4 and 1,211,250 in year 5 Question 20 1 pts By including all the components, what are the incremental free cash flows (FCFS) over the lifetime of the equipment? Note: Please input a whole number for each of the following blanks. The FCF for today is The FCF is per year from year 1 to year 4. The FCF is for year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts