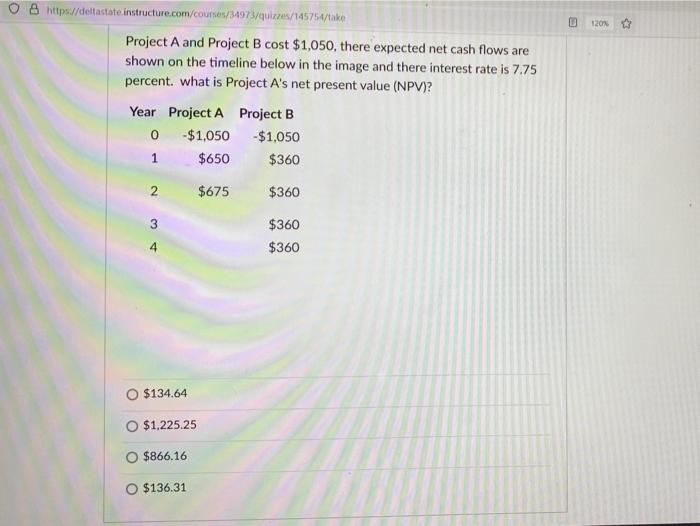

Question: D 120% O B https://deltastate instructure.com/courses/34973/quizzes/145754/take Project A and Project B cost $1,050, there expected net cash flows are shown on the timeline below in

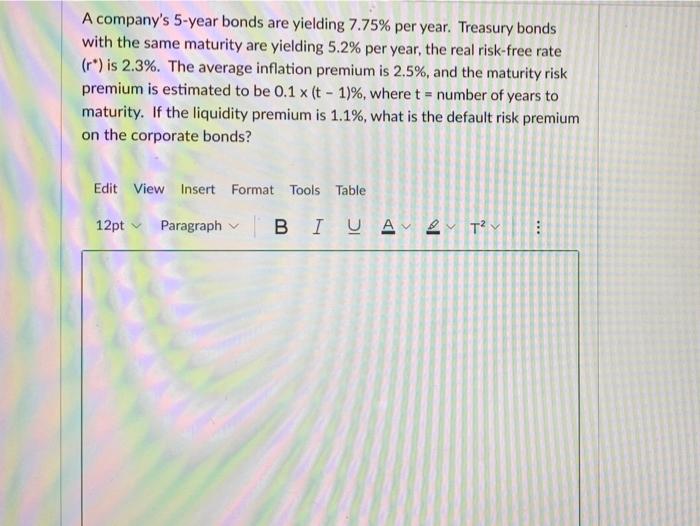

D 120% O B https://deltastate instructure.com/courses/34973/quizzes/145754/take Project A and Project B cost $1,050, there expected net cash flows are shown on the timeline below in the image and there interest rate is 7.75 percent. what is Project A's net present value (NPV)? Year Project A Project B 0 -$1,050 -$1,050 $650 $360 1 2 $675 $360 3 $360 $360 4 $134.64 O $1,225.25 O $866.16 O $136.31 A company's 5-year bonds are yielding 7.75% per year. Treasury bonds with the same maturity are yielding 5.2% per year, the real risk-free rate (r*) is 2.3%. The average inflation premium is 2.5%, and the maturity risk premium is estimated to be 0.1 x (t-1)%, where t = number of years to maturity. If the liquidity premium is 1.1%, what is the default risk premium on the corporate bonds? Edit View Insert Format Tools Table 12pt Paragraph I BI U Avev Tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts