Question: D. -700 6. For a two-stock portfolio, the maximum reduction in risk occurs when the coefficient between the two stocks equals B.-05. 7. You obtain

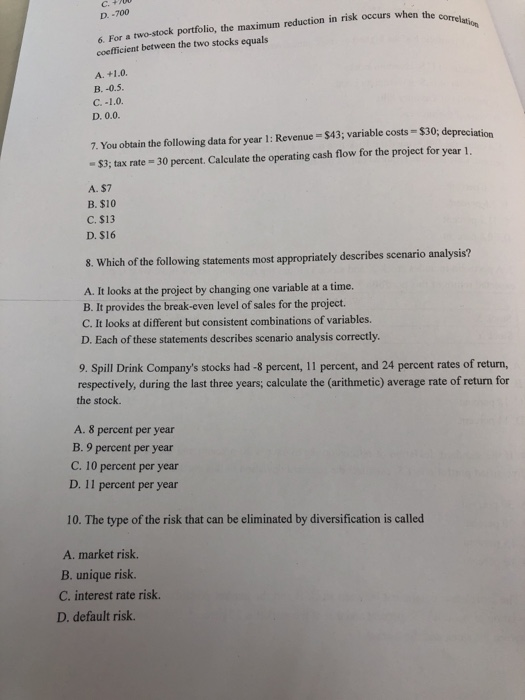

D. -700 6. For a two-stock portfolio, the maximum reduction in risk occurs when the coefficient between the two stocks equals B.-05. 7. You obtain the following data for year 1: Revenue $43; variable costs $30, depreciation $3; tax rate-30 percent. Calculate the operating cash flow for the project for year 1 A. $7 B. $10 C. $13 D. $16 8. Which of the following statements most appropriately describes scenario analysis? A. It looks at the project by changing one variable at a time B. It provides the break-even level of sales for the project C. It looks at different but consistent combinations of variables. D. Each of these statements describes scenario analysis correctly 9. Spill Drink Company's stocks had -8 percent, 11 percent, and 24 percent rates of return, respectively, during the last three years; calculate the (arithmetic) average rate of return for the stock A. 8 percent per year B. 9 percent per year C. 10 percent per year D. I1 percent per year 10. The type of the risk that can be eliminated by diversification is called A. market risk. B. unique risk. C. interest rate risk. D. default risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts