Question: d. ABC company is considering purchasing a new rubber extrusion line that produces rolling bands, flanks, and other products used in the process of tire

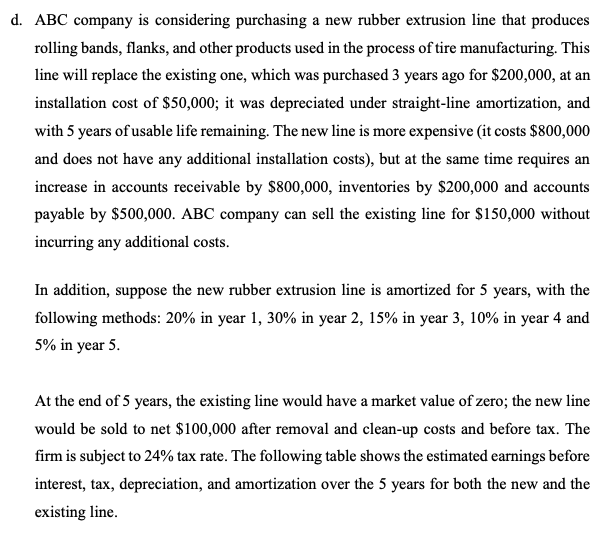

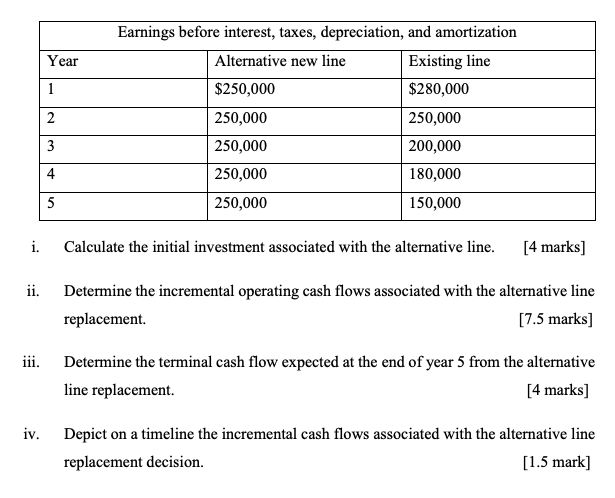

d. ABC company is considering purchasing a new rubber extrusion line that produces rolling bands, flanks, and other products used in the process of tire manufacturing. This line will replace the existing one, which was purchased 3 years ago for $200,000, at an installation cost of $50,000; it was depreciated under straight-line amortization, and with 5 years of usable life remaining. The new line is more expensive (it costs $800,000 and does not have any additional installation costs), but at the same time requires an increase in accounts receivable by $800,000, inventories by $200,000 and accounts payable by $500,000. ABC company can sell the existing line for $150,000 without incurring any additional costs. In addition, suppose the new rubber extrusion line is amortized for 5 years, with the following methods: 20% in year 1, 30% in year 2, 15% in year 3, 10% in year 4 and 5% in year 5. At the end of 5 years, the existing line would have a market value of zero; the new line would be sold to net $100,000 after removal and clean-up costs and before tax. The firm is subject to 24% tax rate. The following table shows the estimated earnings before interest, tax, depreciation, and amortization over the 5 years for both the new and the existing line. Year 1 2 Earnings before interest, taxes, depreciation, and amortization Alternative new line Existing line $250,000 $280,000 250,000 250,000 250,000 200,000 250,000 180,000 250,000 150,000 3 4 5 i. Calculate the initial investment associated with the alternative line. [4 marks] ii. Determine the incremental operating cash flows associated with the alternative line replacement [7.5 marks] iii. Determine the terminal cash flow expected at the end of year 5 from the alternative line replacement [4 marks] iv. Depict on a timeline the incremental cash flows associated with the alternative line replacement decision. [1.5 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts