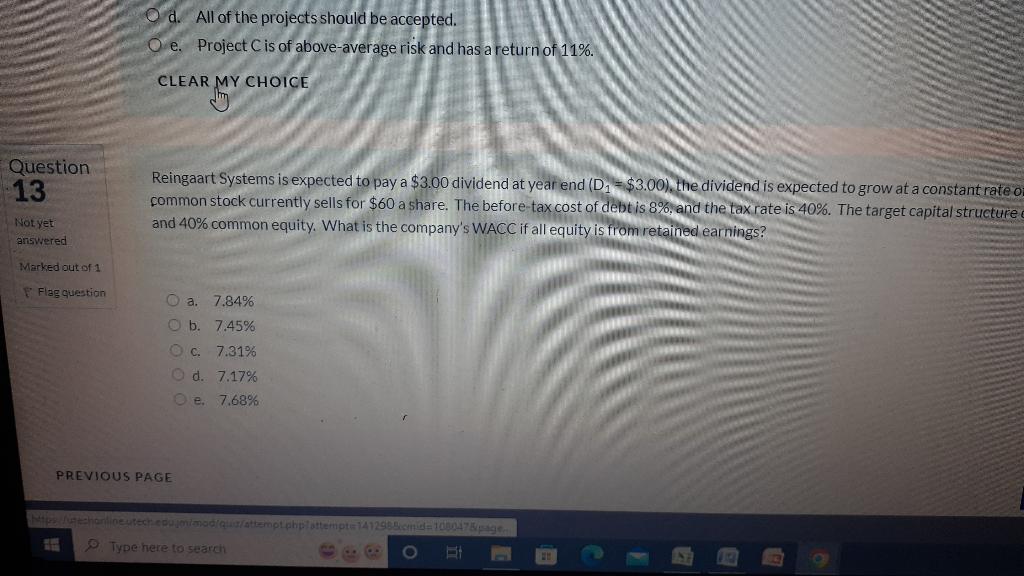

Question: d. All of the projects should be accepted. e. Project C is of above-average risk and has a return of 11% CLEAR MY CHOICE Reingaart

d. All of the projects should be accepted. e. Project C is of above-average risk and has a return of 11% CLEAR MY CHOICE Reingaart Systems is expected to pay a $3.00 dividend at year end (D1=$3.00) the dividend is expected to grow at a constant rate 0 common stock currently sells for $60 a share. The before-tax cost of debt is 8%, and the tax rate is 40%. The target capital structure and 40% common equity. What is the company's WACC if all equity is from retained earnings? a. 7.84% b. 7.45% c. 7.31% d. 7.17% e. 7.68% d. All of the projects should be accepted. e. Project C is of above-average risk and has a return of 11% CLEAR MY CHOICE Reingaart Systems is expected to pay a $3.00 dividend at year end (D1=$3.00) the dividend is expected to grow at a constant rate 0 common stock currently sells for $60 a share. The before-tax cost of debt is 8%, and the tax rate is 40%. The target capital structure and 40% common equity. What is the company's WACC if all equity is from retained earnings? a. 7.84% b. 7.45% c. 7.31% d. 7.17% e. 7.68%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts