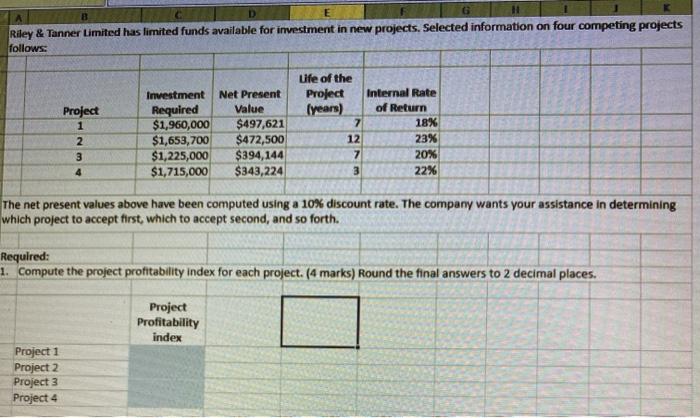

Question: D B C E Riley & Tanner Limited has limited funds available for investment in new projects. Selected information on four competing projects follows: Project

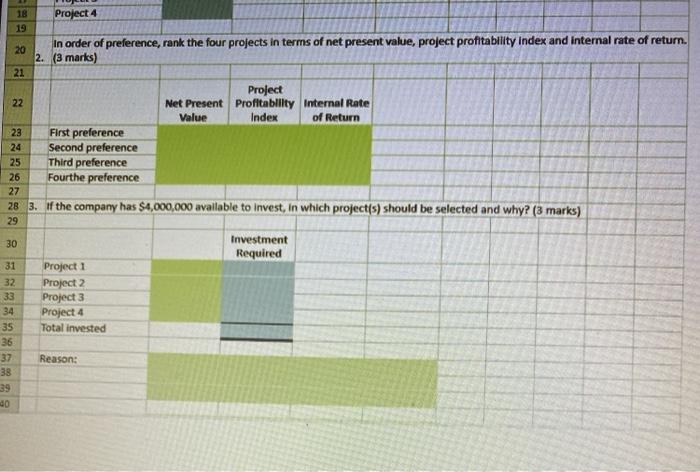

D B C E Riley & Tanner Limited has limited funds available for investment in new projects. Selected information on four competing projects follows: Project 1 2 3 4 Investment Required $1,960,000 $1,653,700 $1,225,000 $1,715,000 Net Present Value $497,621 $472,500 $394,144 $343,224 Life of the Project (years) 7 12 7 3 Internal Rate of Return 18% 23% 20% 22% The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, which to accept second, and so forth. Required: 1. Compute the project profitability index for each project. (4 marks) Round the final answers to 2 decimal places. Project Profitability index Project 1 Project 2 Project 3 Project 4 18 Project 4 19 20 In order of preference, rank the four projects in terms of net present value, project profitability Index and internal rate of return. 2. (3 marks) 21 Project 22 Net Present Profitability Internal Rate Value Index of Return 23 First preference 24 Second preference 25 Third preference 26 Fourthe preference 27 28 3. If the company has $4,000,000 available to invest in which project(s) should be selected and why? (3 marks) 29 30 Investment Required 31 Project 1 32 Project 2 33 Project 3 34 Project 4 35 Total invested 36 37 Reason: 38 39 do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts